Intel’s long-awaited turnaround looks farther away than ever after the company reported dismal first-quarter earnings. Investors pushed the shares down 10% on Friday to their lowest level of the year.

Although Intel’s revenue is no longer shrinking and the company remains the biggest maker of processors that power PCs and laptops, sales in the first quarter trailed estimates. Intel also gave a soft forecast for the second quarter, suggesting weak demand.

It was a tough showing for CEO Pat Gelsinger, who’s early in his fourth year at the helm.

But Intel’s problems are decades in the making.

Before Gelsinger returned to the company in 2021, the company, once synonymous with “Silicon Valley,” had lost its edge in semiconductor manufacturing to overseas rivals like Taiwan Semiconductor Manufacturing Co. Now, in a high-risk quest, it’s spending billions per quarter to regain ground.

“Job number one was to accelerate our efforts to close the technology gap that was created by over a decade of underinvestment,” Gelsinger told investors on Thursday. He said the company is still on track to catch up by 2026.

Investors remain skeptical. Intel is the worst-performing tech stock in the S&P 500 this year, down 37%. Meanwhile, the two best-performing stocks in the index are chipmaker Nvidia and Super Micro Computer, which has been boosted by surging demand for Nvidia-based artificial intelligence servers.

Intel, long the most valuable U.S. chipmaker, is now one-sixteenth the size of Nvidia by market cap. It’s also smaller than Qualcomm, Broadcom, Texas Instruments, and AMD. For decades, it was the largest semiconductor company in the world by sales, but suffered seven straight quarters of revenue declines recently, and was passed by Nvidia last year.

Gelsinger is betting on a risky business model change. Not only will Intel make its own branded processors, but it will act as a factory for other chip companies that outsource their manufacturing — a group of companies that includes Nvidia, Apple, and Qualcomm. Its success acquiring customers will depend on Intel regaining “process leadership,” as the company calls it.

Other semiconductor companies would like an alternative to TSMC so they don’t have to rely on a single supplier. U.S. political leaders including President Biden call Intel an American chip champion and say the company is strategically an important part of the U.S. processor supply chain.

“Intel is a big, iconic semiconductor company which has been the leader for many years,” said Nicholas Brathwaite, managing partner at Celesta Capital, which invests in semiconductor companies. “And I think it’s a company that is worth trying to save, and they have to come back to competitiveness.”

But the chipmaker isn’t doing itself any favors.

“I think everyone has been hearing them say the next quarter will be better for two, three years now,” said Counterpoint analyst Akshara Bassi.

Intel has fumbled the ball for years. It missed the mobile chip boom with the unveiling of the iPhone in 2007. It’s also been largely on the sidelines of the AI craze while companies like Meta, Microsoft and Google order as many Nvidia chips as they can.

Here’s how Intel ended up where it is today.

The iPhone could have had an Intel chip inside. When Apple developed the first iPhone, then-CEO Steve Jobs visited former Intel CEO Paul Otellini, according to Walter Isaacson’s 2011 biography “Steve Jobs.”

They discussed whether Intel should power the iPhone, which had not been released yet, Jobs and Otellini told Isaacson. When the iPhone was first revealed, it was marketed as a phone that ran the Apple Mac operating system. It would’ve made sense to use Intel chips, which ran on the best desktops at the time, including Apple’s Macs.

Jobs said that Apple passed on Intel’s chips because the company was “slow” and Apple didn’t want the same chips to be sold to its competitors. Otellini said that while the tie-up would have made sense, the two companies couldn’t agree on a price or who owned the intellectual property, according to Isaacson.

The deal never happened. Instead, Apple went with Samsung chips when the iPhone launched in 2007. Apple bought PA Semi in 2008 and introduced its first homegrown iPhone chip in 2010.

Within five years, Apple started shipping hundreds of millions of iPhones. Overall smartphone shipments — including Android phones designed to compete with Apple — surpassed PC shipments in 2010.

Nearly every modern smartphone uses an Arm-based chip instead of Intel’s x86 technology which was created for PCs in 1981 and is still in use.

Arm chips built by Apple and Qualcomm consume less power than Intel’s processors, making them more desirable for small devices like smartphones that run on batteries.

A customers looks at an iPhone 15s at the Apple store in Palo Alto, Calif., on Sept. 22, 2023. Tayfun Coskun / Anadolu Agency via Getty Images file

Arm-based chips quickly improved due to the enormous manufacturing volumes and the demands of an industry that needs new chips every year with faster performance and fresh features. Apple started placing huge orders with TSMC to build its iPhone chips, starting with the A8 in 2014. The tech giant’s orders provided the cash to annually upgrade the manufacturing equipment at TSMC, which eventually surpassed Intel.

By the end of the decade, some benchmarks had the fastest phone processors rivaling Intel’s PC chips for some tasks while consuming far less power. Around 2017, mobile chips from Apple and Qualcomm started adding AI parts to their chips called neural processing units, another advancement over Intel’s PC processors. The first Intel-based laptop with an NPU shipped late last year.

Intel has since lost share in its core PC chip business to chips that grew out of the mobile revolution.

Apple stopped using Intel in its PCs in 2020. Macs now use Arm-based chips, and some of the first mainstream Windows laptops with Arm-based chips are coming out later this year. Low-cost laptops running Google ChromeOS are increasingly using Arm, too.

“Intel lost a big chunk of their market share because of Apple, which is about 10% of the market,” Gartner analyst Mikako Kitagawa said.

Intel made efforts to break into smartphones. It released an x86-based mobile chip called Atom that was used in the 2012 Asus Zenphone. But it never sold well and the product line was dead by 2015.

Intel’s mobile stumble set the stage for a lost decade.

Processors get faster with more transistors. Each one allows them to do more calculations. The original Intel microprocessor from 1971, the 4004, had about 2,000 transistors. Now Intel’s chips have billions of transistors.

Semiconductor companies fit more transistors on chips by shrinking them. The size of the transistor represents the “process node.” Smaller numbers are better.

The original 4004 used a 10-micrometer process. Now, TSMC’s best chips use a 3-nanometer process. Intel is currently at 7-nanometers. Nanometers are 1,000 times smaller than micrometers.

Engineers, especially at Intel, took pride in regularly delivering smaller transistors. Brathwaite, who worked at Intel in the 1980s, said Intel’s process engineers were the company’s “crown jewels.” People in the technology industry relied on “Moore’s Law,” coined by Intel co-founder Gordon Moore, that said the amount of computing power would double and become cheaper at predictable intervals, roughly every two years.

Moore’s Law meant that Intel’s software partners, like Microsoft, could count on the next generation of PCs or servers being more powerful than the current generation.

The expectation of continuous improvement at Intel was so strong that it even had a nickname: “tick-tock development.” Every two years, Intel would release a chip on a new process (tick) and in the subsequent year, it would refine its design and technology (tock).

In 2015, under CEO Brian Krzanich, it became clear that Intel’s 10nm process was delayed, and that the company would continue shipping its most important PC and server processors using its 14nm process for longer than the normal two years. The tick-tock process had added an extra tock by the time the 14nm chips shipped in 2017. Intel officials today say that the issue was underinvestment, specifically on EUV lithography machines made by ASML, which TSMC enthusiastically embraced.

The delays compounded at Intel. The company missed its deadlines for the next process, 7nm — eventually revealing the issue in a bullet point in the small print in a 2020 earnings release, causing the stock to plunge, and clearing the way for Gelsinger, a former Intel engineer, to take over.

While Intel was struggling to keep its legendary pace, Advanced Micro Devices, Intel’s historic rival for server and PC chips, took advantage.

AMD is a “fabless” chip designer. It designs its chips in California, and has TSMC or GlobalFoundries manufacture them. TSMC didn’t have the same issues with 10nm or 7nm, and that meant that AMD’s chips were competitive or better than Intel’s in the latter half of the decade, especially for certain tasks.

AMD, which barely had market share in server CPUs a decade ago, started taking Intel’s business in that area. AMD made over 20% of server CPUs sold in 2022, and shipments grew 62% that year, according to an estimate from CounterPoint Research last year. AMD surpassed Intel’s market cap the same year.

Graphics processor units, or GPUs, were originally designed to play sophisticated computer games. But computer scientists knew they were also ideal for running the kind of parallel calculations that AI algorithms require.

The broader business community caught on after OpenAI released ChatGPT in 2022, helping Nvidia triple sales over the past year. Companies are spending money on pricey servers again.

AI-oriented GPU-based servers sometimes pair as many as eight Nvidia GPUs to one Intel CPU. In older servers, the Intel CPU was almost always the most expensive and important part. In a GPU-based server, it’s Nvidia’s chips.

Nvidia recently announced a version of its latest “Blackwell” GPU that cuts Intel out entirely. Two Nvidia B100 GPUs are paired with one Arm-based processor.

Almost all Nvidia GPUs used for AI are made by TSMC in Taiwan, using leading-edge techniques to produce the most advanced chip.

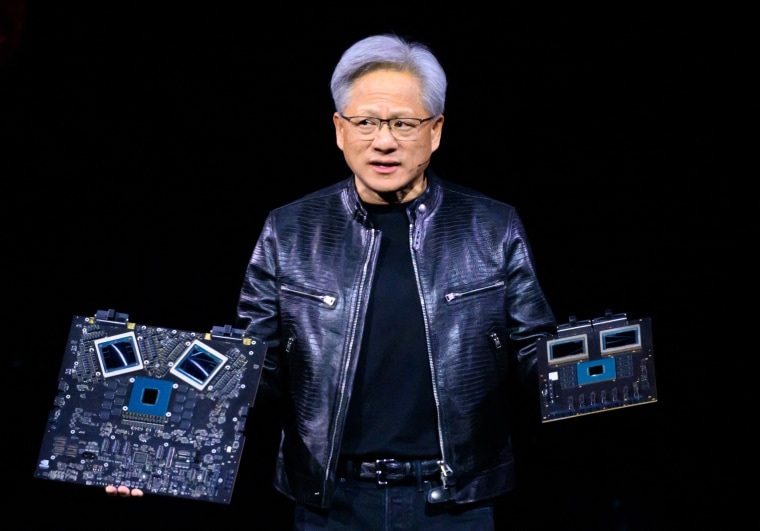

NVIDIA’s CEO Jensen Huang displays products on-stage during the annual Nvidia GTC Artificial Intelligence Conference in San Jose, Calif., on March 18.Josh Edelson / AFP via Getty Images file

Intel doesn’t have a GPU competitor to Nvidia’s AI accelerators, but it has an AI chip called Gaudi 3. Intel started focusing on AI for servers in 2018 when it bought Habana Labs, whose technology became the basis for the Gaudi chips. The chip is manufactured on a 5nm process, which Intel doesn’t have, so the company relies on an external foundry.

Intel says it expects $500 million in Gaudi 3 sales this year, mostly in the second half. For comparison, AMD expects about $2 billion in annual AI chip revenue. Meanwhile, analysts polled by FactSet expect Nvidia’s data center business — its AI GPUs — to account for $57 billion in sales during the second half of the year.

Still, Intel sees an opportunity and has recently been talking up a different AI story — that it could eventually be the American producer of AI chips, maybe even for Nvidia.

The U.S. government is subsidizing a massive Intel fab outside of Columbus, Ohio, as part of $8.5 billion in loans and grants toward U.S. chipmaking. Gelsinger said last month that the plant will offer leading-edge manufacturing when it comes online in 2028, and will make AI chips — perhaps those of Intel’s rivals, Gelsinger said on a call with reporters in March.

Intel has faced its old failures since Gelsinger took the helm in 2021, and is actively trying to catch up to TSMC through a process that Intel calls “four nodes in five years.”

It hasn’t been easy. Gelsinger referred to its goal to regain leadership as a “death march” in 2022.

Now, the march is starting to reach its destination, and Intel said on Thursday that it’s still on track to catch up by 2026. At that point, TSMC will be shipping 2nm chips. Intel said it will begin producing its “18A” process, equivalent to 2nm, by 2025.

It hasn’t been cheap, either. Intel reported a $2.5 billion operating loss in its foundry division on $4.4 billion in mostly internal sales. The sums represent the vast investments Intel is making in facilities and tools to make more advanced chips.

“Setup costs are high and that’s why there’s so much cash burn,” said Bassi, the CounterPoint analyst. “Running a foundry is a capital-intensive business. That’s why most of the competitors are fabless, they are more than happy to outsource it to TSMC.”

Intel last month reported a $7 billion operating loss in its foundry in 2023.

“We have a lot of these investments to catch up flowing through the P&L,” Gelsinger told CNBC’s Jon Fortt on Thursday. “But basically, what we expect in ’24 is the trough.”

Not many companies have officially signed up to use Intel’s fabs. Microsoft has said it will use them to manufacture its server chips. Intel says it’s already booked $15 billion in contracts with external companies for the service.

Intel will help its own business and enable better performance in its products if it regains the lead in making the smallest transistors. If that happens, Intel will be back, as Gelsinger is fond of saying.

On Thursday, Gelsinger said demand was high for this year’s forthcoming server chips using Intel 3, or its 3nm process, and that it could win customers who had defected to competitors.

“We’re rebuilding customer trust,” the CEO said on Thursday. “They’re looking at us now saying ‘Oh, Intel is back.’”

This post appeared first on NBC NEWS