The race to the playoffs has become a slog of attrition.

It’s late August and the Major League Baseball landscape is littered with the remains of the mediocre. At the halfway point, a half-dozen teams looked likely to win 100 games; now, that number may be zero by the end of September.

Of course, excuses abound – many of them valid. MLB’s injured list has been well-decorated with star pitchers since the first week of the season, but as the stretch drive unfolds, it’s clear some teams have been hit harder than others.

With that, a look at the nine contenders who have been crushed the most by injuries – and the prognosis for better health as the season unwinds:

1. Atlanta Braves

Gone for good: RH Spencer Strider (reconstructive elbow surgery, April 13); OF Ronald Acuña Jr. (torn right ACL, May 26); LHP A.J. Minter (hip surgery, Aug. 13)

Follow every MLB game: Latest MLB scores, stats, schedules and standings.

It’s been a while: 2B Ozzie Albies (left wrist fracture, July 21, out until mid-September); 3B Austin Riley (right hand fracture, Aug. 19, out for rest of regular season).

Short-term pain: OF Jorge Soler (hamstring, day-to-day); C Travis d’Arnaud (wrist, day-to-day).

Outlook: They were the leaders in the clubhouse in this category with Strider and Acuña’s demises, and then Albies and Riley’s fractures further decimated the lineup. The good news: Pitchers Max Fried and Reynaldo Lopez are back off the IL. The bad news: They have just a two-game edge for the final wild-card spot. Buckle up.

2. Baltimore Orioles

Gone for good: INF Jorge Mateo (elbow, July 24); RH Kyle Bradish (Tommy John surgery, June 19); RH Tyler Wells (Elbow reconstruction surgery, June 17); LH John Means (Tommy John surgery, June 13); RH Felix Bautista (Tommy John surgery, October 2023).

It’s been a while: RH Zach Eflin (shoulder inflammation, Aug. 20, out until September); RH Grayson Rodriguez (mild right lat strain, Aug. 10, out until September); INF Jordan Westburg (right hand fracture, July 31, out until September); LH Danny Coulombe (elbow surgery, June 19, out until mid-September); OF Heston Kjerstad (concussion, Aug. 7, out indefinitely)

Short-term pain: RH Jacob Webb (elbow inflammation, Aug. 7).

Outlook: They brought in Corbin Burnes to anchor the rotation. Dealt for Eflin and Trevor Rogers to backfill for the season-ending losses of Bradish, Means and Wells. And then Eflin and fellow right-hander Grayson Rodriguez hit the injured list in rapid succession. Their September injury reports will have the biggest impact on the AL pennant chase: The welfare of their two righty aces, Westburg and Coulombe may make the difference between limping into the playoffs and looking like World Series favorites.

3. Houston Astros

Gone for good: RH Cristian Javier (Tommy John surgery, June 16); RH Jose Urquidy (Tommy John surgery, June 7); RH J.P. France (shoulder surgery, July 2); RH Luis Garcia (Tommy John recovery); RH Lance McCullers Jr. (forearm).

It’s been a while: OF Kyle Tucker (right shin contusion, June 7, out until at least September); RH Kendall Graveman (shoulder surgery, January, possible return in late September).

Short-term pain: RH Ryan Pressly (lower back strain, Aug. 14, expected back next week).

Outlook: Now that Justin Verlander is back, it’s easy to forget that Houston shelved nearly an entire rotation of arms before summertime. Yet it’s Tucker’s return from a shin injury that’s most vexing and perhaps most impactful. It now seems likely his recovery from a shin injury will stretch to three months, and the Astros would be happy if the MVP-caliber slugger has a runway to get up to speed by the postseason.

4. New York Yankees

Gone for good: RH Jonathan Loaisiga (Tommy John surgery, April 6)

It’s been a while: RH Clarke Schmidt (right lat strain, May 31, out until September); INF/OF Jazz Chisholm (left elbow ligament tear, Aug. 14, out for at least another week); RHP Ian Hamilton (right lat strain, June 18, out until next week); 1B Anthony Rizzo (right forearm fracture, June 18, out indefinitely)

Short-term pain: RH Luis Gil (lower back strain, Aug. 20, out until at least Sept. 5)

Outlook: The rotation has made do without Schmidt, thanks largely to Gerrit Cole’s return and Nestor Cortes and Marcus Stroman’s ability to keep the wheels largely on the road. Yet the club’s division and playoff hopes would be greatly enhanced if Schmidt can both complete his return from a lat strain and largely resume the form that produced a 2.52 ERA. Chisholm’s injury was a big blow after his instant impact following the trade deadline, but he should be able to rejoin the lineup come September.

5. Los Angeles Dodgers

Gone for good: RH River Ryan (Tommy John surgery, Aug. 13); RH Dustin May (esophagus surgery, July 13); RH Emmet Sheehan (reconstructive elbow surgery, May 16); RH Tony Gonsolin (Tommy John surgery, Feb. 9).

It’s been a while: RH Yoshinobu Yamamoto (shoulder, triceps, June 16, out until September)

Short-term pain: RH Tyler Glasnow (elbow tendinitis, Aug. 19, expected back Sept. 1; RH Blake Treinen (hip, Aug. 5, activated Wednesday); INF/OF Chris Taylor (left groin strain, July 25, expected back this week); C Austin Barnes (toe, Aug. 19, expected back Aug. 30).

Outlook: A grim year for young arms in the organization. Beyond the season-ending losses, all eyes are on the returns of Glasnow – taking his second IL respite of the second half after his odometer hit 134 innings, 14 over his career high – and Yamamoto. The $325 million import was scheduled for a two-inning simulated game, which should lead to a rehab assignment beginning sometime next week – just as the calendar flips to September.

6. Milwaukee Brewers

Gone for good: OF Christian Yelich (back surgery, July 25); RH Brandon Woodruff (shoulder, March 24); LH Wade Miley (reconstructive elbow surgery, May 7); LH Robert Gasser (Tommy John surgery, June 26).

Out for a while: RH Enoli Paredes (forearm tendinitis, July 3, out until September); LH Hoby Milner (shoulder impingement, Aug. 11, out until September).

Short-term pain: OF Blake Perkins (right calf strain, Aug. 12, expected back this week).

Outlook: Yelich’s loss is brutal, in that his .909 OPS (151 adjusted) was his most productive season since his 2019 MVP runner-up campaign. The pitching staff has been strafed with injuries, but the Brewers always have a couple dozen arms to pull from and find innings. And now they have an 11-game NL Central lead to play with.

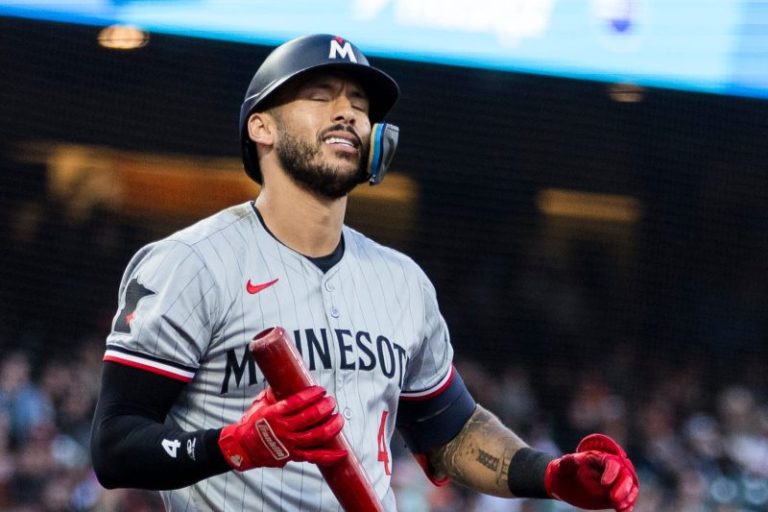

7. Minnesota Twins

Gone for good: RH Joe Ryan (teres major shoulder strain, Aug. 9); RH Brock Stewart (shoulder surgery, July 31); RH Anthony Desclafani (flexor tendon surgery).

It’s been a while: SS Carlos Correa (heel, July 20, out until September); OF Alex Kiriloff (back, ankle, June 18, out until September); RH Chris Paddack (forearm strain, July 14, out until at least late September).

Short-term pain: CF Byron Buxton (right hip inflammation, Aug. 13, expected back this weekend); INF Brooks Lee (right biceps tendinitis, expected back next week).

Outlook: They’ve very quietly been flourishing without Correa, winning 11 of 19 this month to keep the pressure on first-place Cleveland. Yet Ryan’s loss – he has a narrow but unlikely chance to return for the playoffs – might have the bigger impact on their postseason outcome. Paddack may have a window to return as a playoff reliever, just like last year.

8. San Diego Padres

It’s been a while: RF Fernando Tatis Jr. (right quadricep, June 24, out until at least mid-September); RH Yu Darvish (restricted list, groin, elbow, May 29, return uncertain); LH Wandy Peralta (left thigh strain, July 12, expected back by September)

Short-term pain: SS Ha-Seong Kim (right shoulder inflammation, Aug. 19, expected back by September)

Outlook: Almost seems silly to include them on this list, since they’re a major league-best 22-6 since the All-Star break. Yet it’s startling to consider that’s all come without Tatis and Darvish. There’s still no timetable for Tatis’s return, as he’s gradually adding activities in his return from a femoral stress reaction; his addition would give the lineup a punishing look nearly from 1 to 9. Darvish has reportedly been throwing during his time on the restricted list, but chances of a return remain unknown.

9. Arizona Diamondbacks

Gone for good: LH Kyle Nelson (thoracic outlet surgery)

It’s been a while: 1B Christian Walker (oblique, July 30, expected back by September), C Gabriel Moreno (left adductor strain, Aug. 6, out until late September).

Short-term pain: 2B Ketel Marte (sprained ankle, Aug. 19, expected back by September).

Outlook: The only good thing about Walker’s injury is it came just a few hours before the trade deadline, enabling them to add veteran Josh Bell, who has contributed four home runs and a capable .769 OPS. It also gives Walker the luxury to not rush back from his oblique strain, among the game’s more vexing maladies.

The USA TODAY app gets you to the heart of the news — fast. Download for award-winning coverage, crosswords, audio storytelling, the eNewspaper and more.

This post appeared first on USA TODAY