I’m not an investment arsonist! I won’t try to convince you that stock market perfection is achievable. I will, however, guarantee (strong word) that if you put in the effort, the results will be as Vince Lombardi often claimed: “Perfection is not attainable, but if we chase perfection, we can catch excellence.” The 10 investing essentials I’ve presented in these two blogs were culled from my own list of 30 essentials. I believe you’ll find them to be helpful.

Two points to make. First, there are no shortcuts to becoming a successful investor. Your learning never stops. Yes, there are, at a minimum 20 more foundational essentials to learn. Second point: be willing to invest the time. Even Warren Buffett’s vast net worth was predominantly accumulated after his 50th birthday. I share with you a quote from William Henley’s poem “Invictus”, whose final lines read “I am the master of my fate. I am the captain of my soul.” Embrace this reality, and you’ll achieve remarkable success in the stock market. Onward!

6. HERE’S YOUR CHALLENGE

You either embrace “PAC”, or you PACK IT IN and give your money to some money manager. PAC stands for PIVOT, ADAPT and CHANGE. This is a reality of investing and a truism of the stock markets. Expect and accept change. William O’Neil preached that following new products and new companies leads to growth, profits, and rising earnings. These disruptors or change-makers are the future darlings of the equities markets.

Even something as seemingly mundane as grocery store inventory can reflect the impact of regular changes. Few realize that 80% of what’s on the shelves today are new or improved products that have been there for five years or less. Think food trends and fads. The days of Campbell soup gave way to healthy organic and sustainable foods lower in salt and preservatives. The stock market reflects these types of changes in our society. Your portfolio must change with the times, too. As Nicolas Darvas wrote in his seminal 1960’s book, “There are no good or bad stocks — only rising and falling stocks.” Accept this fact, embrace the challenge, pivot, and adapt. PAC!

7. INVESTING DEMENTIA

There’s the good kind of investing dementia and the bad kind. Understand both!

Exceptional professional athletes become adept at the good kind. Sports require a short memory. What happened with the last play, last goal, or last period mustn’t negatively impact the next play, next goal, or next period. The bad kind applies to everyone — be it in the sports arena, business world, investing theater or life. When you don’t acknowledge mistakes you’ve made, and thereby make them again, that’s pure stupidity. Or you simply forget the lessons you’ve learned, thereby losing sight of the past and not remembering what you had once known. You get lazy, and allow your ego to tell you something different. Yes, it takes focus, concentration and discipline to learn from your mistakes and remember not to step into the same cow dung twice. Stan Druckenmiller — the ‘Market Wizard’ — once said, “Every great money manager I’ve ever met, all they want to talk about is their mistakes. There’s a great humility there.” A big ego and a selective memory is a toxic mix in the investment coliseum.

Investing attracts many successful people with high IQs. All too often, these folks bring their oversized egos to the table, accompanied by a fair amount of psychological baggage that they didn’t realize they had or didn’t think mattered. The markets have a way to ensure that these folks do a belly-flop and lose their bathing suits. Intuition and IQ have little relevance in the stock market until they’re backed up by the prerequisites of competence and expertise. That takes a committed effort over time.

An immense part of that is what we address in Stage 3 of Stock Market Mastery: The Investor Self. If you truly embrace the fact that the majority — yes, I said majority — of your consistent long-term success in the markets depends upon your mental skills and self control, then you’ll be a winner. You will steadily and predictably progress through the five levels of investor growth. Just remember, egos are toxic in investing.

8. THE IMPORTANCE OF A METHODOLOGY

If you can’t explicitly describe your investment methodology, you probably don’t have one! Start by putting it down in writing. Once you’ve outlined your investing approach, I submit to you a number of good things will happen.

You’ll feel less stressed.You’ll stay more organized.The market will reward you for your efforts.

I humbly suggest you use our book Tensile Trading: The 10 Essential Stages of Stock Market Mastery as a foundation, and then personalize it over time as you deem fit. Think of it as a roadmap to help peel back the 10 layers of the stock market. You’ll clearly recognize there’s DNA from many Market Wizards incorporated in each of the 10 Stages. This approach is the antithesis of reading newsletters and accepting stock tips. Instead, this is all about learning a skill set you can replicate. I think this ancient and timeless wisdom remains so very apropos for modern investors. “Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime.” A profound truth we should all embrace as investors.

9. DISCIPLINE

Having the discipline to follow your routines is what separates the winners from the losers. Successful investing is not dissimilar to professional sports. For a championship result, it’s all about doing a myriad of little things that add up to achieving a significant result; small routines which reinforce each other. Not dissimilar to the elements that make up your investment methodology and stack atop one another to create a basket of probability enhancers. The stock market is all about probabilities. You must endeavor to find each and every element that will contribute to increasing positive probabilities and adding these to your investing methodology.

In fact, this is not the biggest challenge. Our book is chock-full of these probability enhancers. We can teach that. But the Achilles heel for most investors is not having the discipline to consistently deploy their routines. If you waver or allow yourself to become lackadaisical, you will ignore something or miss something altogether. The market will catch your blindness and extract the requisite tuition.

Market Wizard Richard Dennis claimed he could publish his trading methodology and rules in the newspaper and very few investors would follow them . Why? He knew so few would ever have the discipline, drive, and commitment to put in the effort. Discipline is your shield to the dark side. The golden road to the rainbow is paved with discipline.

10. FACTS, JUST THE FACTS

Truth holds power. These days, however, the Investment Salad is composed of information, disinformation and artificial intelligence, which I refer to as synthetic truth. Discerning the truth is an ongoing battle. Social media has created a dense stock market fog with a medley of distortions, bias, lies, propaganda, and misinformation, as well as deliberate disinformation.

The first truth to embrace is that truth itself is not always easily available. The second truth is that there exists a lot of disinformation haze. Seldom will you have clear sight lines. Having acknowledged these truths, I follow eight simple caveats that have served me very well over time. I’d like to share these with you.

a. Fact-check what you can.

b. Do not put much faith in the so-called experts.

c. You’ll never know everything you’d like to know. Get used to it.

d. Don’t focus too much on short-term sensational news.

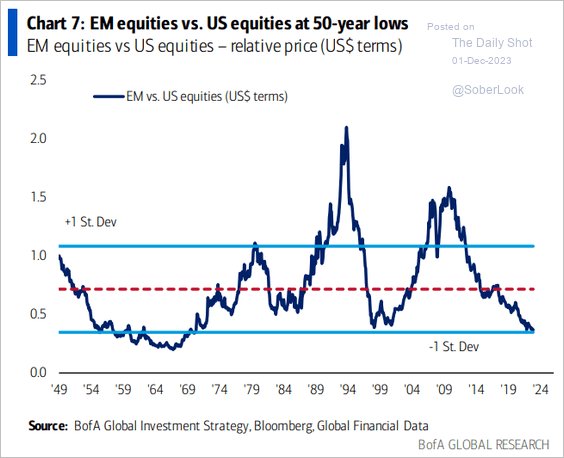

e. Don’t believe it when the pundits claim “it’s different this time.”

f. You must be willing to adapt and change when reality presents itself.

g. An historical truism of stock equity prices — the cheap get cheaper. The dear get dearer. Don’t fight it.

h. My favorite caveat: Price charts don’t lie. I trust them. I believe in their message. They are the final arbitrator.

BONUS: A gift to you this Holiday Season. Being immersed in Black Friday and Cyber Monday sales, I thought it only reasonable to extend to you my own December Deals.

Our Blu-Ray had been steeply discounted for those of you who might prefer to watch DVDs versus reading our book — The 10 Essential Stages of Stock Market Mastery.

The Asset Allocation DVD that Grayson and I produced is also steeply discounted. This is another great stocking stuffer for parents endeavoring to boost the financial IQ of the younger generation.

Wishing you great investing success in 2024!