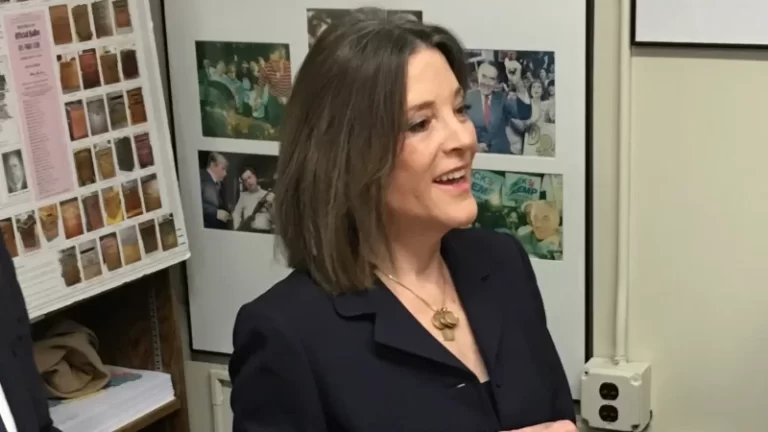

Spiritual adviser and bestselling self-help author Marianne Williamson officially declared her candidacy for president on Saturday, launching a 2024 Democratic primary challenge against President Biden.

‘The status quo will not disrupt itself… that’s our job,’ Williamson said at her campaign kickoff event at Washington D.C.’s Union Station.

‘We know that this country is plagued by many challenges now, not the least of which is hatred and division, which is greater than any of us have experienced national life. It is our job to create a vision of justice and love that is so powerful that it will override the forces of hatred and injustice and fear,’ Williamson said in her speech.

Williamson, who called for reparations and a Department of Peace as part of her unsuccessful long-shot campaign for the 2020 Democratic presidential nomination, becomes the first Democrat with a national following to primary challenge the 80-year-old president.

Most leaders in the Democratic Party from both the establishment and progressive wings say they will support Biden, who is expected in the coming weeks or months to announce his re-election campaign for a second term in the White House.

Williamson did not mention Biden in her speech Saturday, but said that not electing former President Donald Trump in 2020 meant that America didn’t go ‘over the cliff.’ She said ‘we’re still 6 inches away from it.’

She painted a dark vision of America with ‘broken windows,’ addiction, poverty and despair. ‘Half the people in this city don’t even notice [despair],’ she said, calling out leaders for lacking the ‘spine or moral courage’ to fix the issues.

‘Ladies and gentlemen, let me in there, I will,’ she said.

Williamson announced her intentions to launch a White House campaign last month in an interview with the Medill News Service, saying ‘I wouldn’t be running for president if I didn’t believe I could contribute to harnessing the collective sensibility that I feel is our greatest hope at this time.’

A few days later, she declared in a Facebook posting and on her website that ‘I’m writing with some big news: on Saturday, March 4, I will formally announce my candidacy for the Democratic nomination for president.’

An adviser in the White House contender’s political circle told Fox News earlier this week that Williamson will travel to South Carolina on Monday and New Hampshire on Wednesday, with stops in Michigan and Nevada in the coming weeks.

‘You can appreciate what the president has done — defeating the Republicans in 2020 — and still feel it is time to move on,’ Williamson said last week in an interview on a New Hampshire news-talk morning radio program.

Williamson told host Jack Heath on ‘Good Morning New Hampshire’ that ‘many of us, myself included, feel that in order for the Democrats to win in 2024, we’re going to have to be able to offer to the American people something much more than’ what she says Biden is offering.

During the 2020 cycle, Williamson was an unconventional candidate who preached the politics of love. She emphasized ‘six pillars for a season of moral repair,’ including economic justice. She proposed creating a Department of Children and Youths and a Department of Peace, and she pushed for reparations for the descendants of African-American slaves. Among her unorthodox acts was holding a meditation session while campaigning in New Hampshire.

But Williamson struggled with fundraising and failed to qualify for most of the Democrat presidential debates. Days after laying off most of her small staff, she dropped out of the race in January 2020, just ahead of the start of the nomination primaries and caucuses.

‘With caucuses and primaries now about to begin, however, we will not be able to garner enough votes in the election to elevate our conversation any more than it is now,’ she said at the time. And pointing to what at that moment was a very competitive race for the Democratic nomination, Williamson added that she didn’t want to ‘get in the way of a progressive candidate winning.’

Williamson traveled to New Hampshire last month ahead of her 2024 announcement, and it’s likely she’ll spend plenty of her time campaigning there going forward. That comes as no surprise as political strategists have said that if there’s going to be a primary challenge against Biden, New Hampshire appears to be the state where the action will take place.

‘Now you have everyone who wants to take a shot at Biden coming to New Hampshire to do it,’ a longtime Granite State-based progressive strategist recently told Fox News as he pointed toward the near certainty of the state holding an unsanctioned Democrat presidential primary next year. ‘New Hampshire is the place where it’s happening.’

New Hampshire, which prides itself on its well-informed electorate and its emphasis on small-scale and grassroots retail politics, has for a century held the first primary in the race for the White House. While Republicans are making no changes to their presidential nominating calendar in the 2024 election cycle, the Democratic National Committee (DNC) last month voted overwhelmingly to approve a new top of the calendar pushed by Biden that upends the traditional schedule.

New Hampshire will now vote second in the DNC’s calendar, along with Nevada, three days after South Carolina, under the new schedule.

But Granite State Democrats warn that New Hampshire will still go first — courtesy of a long-standing state law that mandates the leadoff primary position — and that a primary not sanctioned by the DNC, where Biden doesn’t take part, could invite trouble for the president.

‘President Biden will not file for election in the New Hampshire primary, which will still go first,’ longtime New Hampshire Democratic Party Chair Ray Buckley emphasized on the eve of the DNC calendar vote. And he warned that ‘this will set him up, we believe, for an embarrassing situation where the first primary in the country will be won by someone other than the president. This will only fuel chatter of about Democrats divisions.’

Buckley’s prediction appears to be materializing with the arrival of Williamson.

Asked about the DNC’s nominating calendar move, she told Politico earlier this year ‘that is spitting in the face of democracy.’

And she’s not alone.

Environmental lawyer and anti-COVID vaccine crusader Robert F. Kennedy Jr. was in New Hampshire on Friday. Kennedy, the son of the late Sen. Robert F. Kennedy and the nephew of the late President John F. Kennedy, defended the primary at an event at the New Hampshire Institute of Politics, which for nearly a quarter-century has been a must-stop in the Granite State for potential or actual White House contenders.