In honor of Women’s History Month and International Women’s Day, we continue our series of articles highlighting women traders who have overcome personal and professional challenges to achieve their personal and financial goals.

In this installment, we hear from Danielle Shay, a self-made trader, market analyst, and regular commentator. Her motivation to have the flexibility to care for her son was the driving force behind her becoming an options trader. With no love for math or science, that was a courageous move, and Danielle’s persistence helped her conquer the many challenges she faced. She is now VP of Options at Simpler Trading. How did she get there? Let’s hear her story.

Danielle, how and when did you first get involved in trading? Who was your biggest influence or mentor while learning how to trade?

I got involved in trading thanks to my dad, who happens to be one of my best mentors. I had just had my first child and wanted to leave his father and my job teaching elementary school. I wanted to find a career that allowed me to work from home so I wouldn’t have to put my son in daycare. My dad introduced me to Simpler Trading online, where I learned how to trade options from John Carter. After studying and paper trading for two years, I began trading real money. I then met John Carter in Las Vegas at a trading seminar. He brought me on to the team to teach beginners due to my teaching experience. Now, I trade and teach online and appear in the media.

In addition to my father, John Carter and Carolyn Boroden (an expert on Fibonacci) are my top two mentors. Carolyn taught me Fibonacci analysis, which is a huge part of the work I do.

That’s terrific. What is it about trading that keeps you going?

I love that each day is a new adventure. It’s never the same, which keeps me on my toes. I love hunting through charts looking for setups that provide opportunities. I also love being able to share those finds with others. I love it when people message or tweet me and let me know they have made money using my published work. This is the ultimate reward! I also love working from home. I can be with not just my now nine-year-old but also my newborn.

Is there anything about trading that you don’t like?

I don’t like losing money! Losing money is a part of trading. You will get things wrong. You will think something is lined up perfectly, and then bam! But, the money you lose is tuition, and every dollar lost is a lesson. I like to compare it to a college degree or any money you spend on education. While it seems different, it really isn’t. When you pay for education via a college degree, you pay for credit hours. When you lose money on a trade, you are paying for that education. It works, as long as you learn from the lessons!

36% of women invest in the markets vs. 63% of men. But a recent study by Fidelity found that women, on average, outperformed their male counterparts by 0.4%. What, in your view, are the main reasons women are reluctant to invest in the markets?

Well, I can tell you from a personal perspective that I was never good at math, and I didn’t like science either. I excelled at English, reading, writing, etc. My degree in college was in International Law & Human Rights. As you can see, that has nothing to do with finance.

When I was in school, finance was overwhelming. However, I realized that trading doesn’t have to be about math or science. Trading is more about recognizing patterns. I am good at learning languages and recognizing patterns, so I apply that skill set in trading. The trading platform does all the math for you.

I’m also creative in nature. This is why I love to teach and come up with classes and courses to help educate traders.

I always thought of finance as something men are better at than women. But, now that I’m in the space, my thoughts have changed. I love teaching men and women and especially love to show women who are like me—those who think finance is too over their heads—to view investing and trading from the lens I use. So, instead of being overwhelmed by math and finance, if you look at investing from the perspective of looking for patterns in life—what stores you shop at, what products you like to buy, which companies do better in those spaces—and from a standpoint of wanting to invest and trade because of the end result—to stay home with your kids, retire, not have to have a job—then I think it’ll be more enticing to women. I’ll give you an example. I love trading ULTA stock. It’s my favorite makeup store, so the stock is on my radar.

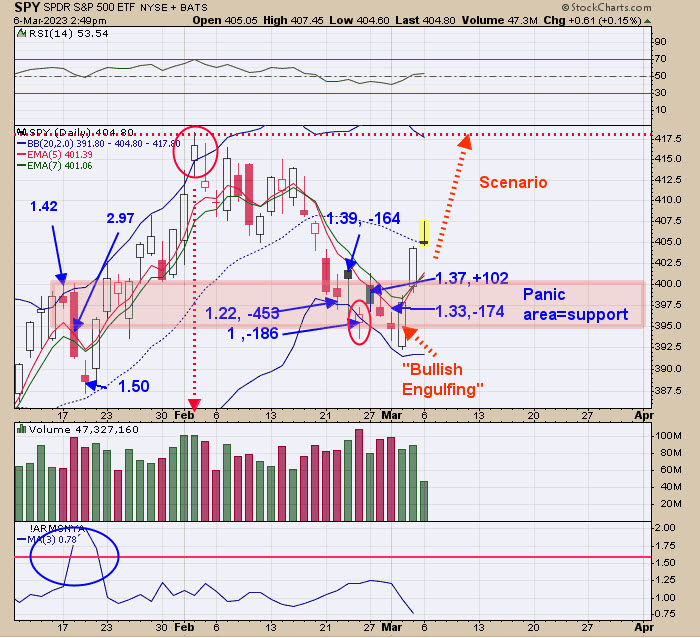

CHART 1: DAILY CHART OF ULTA STOCK. Click on chart for live version. Chart source: StockCharts.com. For illustrative purposes only.

ULTA has been doing pretty well. Danielle, we understand you’re primarily an options trader. Given that you weren’t a fan of math, how did your interest in options develop and what challenges did you face, given there are more male options traders than female ones?

I developed an interest in options primarily because I was broke and had only a small amount to trade with. After leaving my son’s father, I also left the financial security that came with it. I left my job and had to learn to trade while working part-time jobs to learn the markets. I spent some time photographing for Zillow. I could walk around and take real estate photographs while learning from the Simpler Trading trading room in my car … no joke!

I didn’t trade options because I found them easy or interesting. I traded options because you can trade options with a small account with the potential to make a measurable difference to your bottom line. At first, I was trading 5k accounts and trying to make $50 a day. I have grown the account size over time, but when I started, there was no way I could have had the money or leverage involved to trade stocks. So, I began with options and funny enough only traded stocks years later. I do all of my underlying analysis on stocks and then trade the options.

I think a big barrier to options trading is that it’s so complicated, but that is why I try to focus on the why instead of pretending it’s interesting 🙂

I got into options trading because my dad had traded them for years, and he knew it was possible. Thankfully, he introduced me to online platforms where I could learn even more. I am fully self-taught and all online!

I am good at learning languages and recognizing patterns, so I apply that skill set in trading. The trading platform does all the math for you.

That’s great. So, what opportunities are you seeing in today’s markets?

So, over the years, I started investing in long-term accounts as well, especially for the kids. Right now, I’m buying stocks for the longer term because of the possibility of a bear market. I use a formula for regularly transferring money into my investment accounts and then dollar-cost average into strong stocks and sectors to build up accounts over time. I’m employing this strategy right now.

As far as trading goes, I trade a lot of earnings reports. I like to trade earnings reports because, regardless of if the market is going up or down, there will always be companies reporting earnings. I like to trade patterns going into earnings—over the earnings report and post-earnings. Last year, if a company was weak, I would go short prior to earnings reports and watch the stock price fall going into the earnings report. This year (2023), I’ve been focusing on strong companies that are recovering and trading higher pre-earnings.

I create an earnings watchlist each week and identify the ticker symbols I think will continue to move higher, post-earnings. In the options market, prior to an earnings report, you can sell premium by trading put credit spreads. When the report comes out, if all goes according to your directional bias, the stock trades higher, and you can close your put credit spread.

Congratulations on all you’ve accomplished and we wish you continued trading success. Thank you for sharing your thoughts with us, Danielle.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.