Partial Look at the Models and Positions

On Friday, I was part of the Festival of Learning, sponsored by Real Vision, to help new and experienced traders. The topics that came up were in line with what everyone who trades wants more insights on:

FOMOPosition SizingRisk ManagementEntries Stops and ExitsPortfolio ManagementManaging Emotions

One question was on AI and Robo Trading, something we know a lot about.

First off, having decades of discretionary trading experience, evolving into algos was a process. All of our rule-based, structured disciplined approaches as discretionary traders are an integral part of the quant models and blends. Our goal is to create an “edge” using equity trends from various markets and asset classes.

The reason I bring this up today is because many of the positions are inline with our personal view of the macro. And many of the positions are following our trend-strength indicators that have placed us in sectors we could have potentially overlooked on our own. What fascinates me, right now, is the injection of liquidity by the Fed, which of course is not being called by its rightful name–Quantitative Easing.

That leads me to think–what else can we buy now, that hasn’t been crowded by the FOMO crowd?

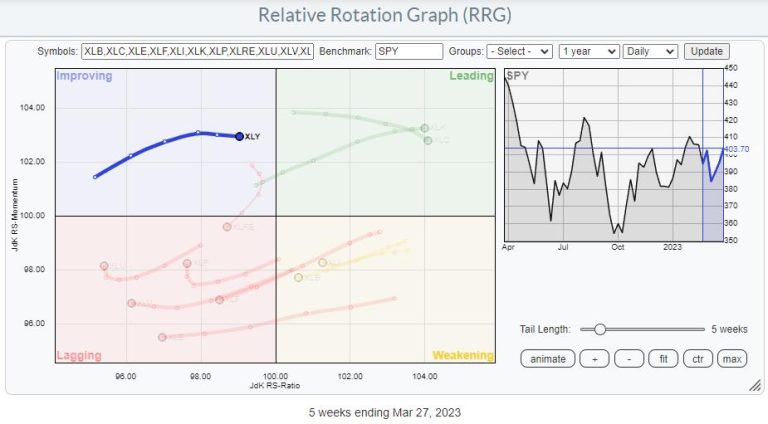

As you can see in the Bloomberg chart, cause/effect for tech, but also for many different sectors begging for the Fed fix.

The Economic Modern Family, though, has many other issues. As the 1st quarter ended, only Semiconductors closed above the 2-year or 23-month business cycle to show expansion. The rest of the Family did not, and Retail and Regional Banks still way underperform. Which could mean more QE on the way, with the rest of the indices and key sectors following SMH, or it could mean a wakeup call for the 2nd quarter.

Either way, we still believe that most are #lookingforinflationinallthewrongplaces.

Sure, the market loves the liquidity in the name of saving any future bank issues. But everything though the Fed does, as we well know, has a cost.

Last week, I wrote about agricultural commodities and DBA, the Ag ETF. Since that Daily, DBA has risen over 4%. So, what should we look for next?

I wrote about long bonds (TLT). TLTs rallied with the market. The good news is that long bonds are underperforming SPY, which is risk on. If yields fall further, however, will that be good for the market when, all of a sudden, the Fed has to become more aggressive again to control rising inflation? Haven’t we learned yet that the more “QE”, the more spending, the more inflation, and so on?

So, watch the bonds. Consider the grains. And since the PCE released Friday excludes food and energy, keep track of precious metals, sugar and crude oil.

Our quants have not gotten into oil yet, so, from a macro perspective, over $82, we are interested.

Look for momentum to clear the 50-DMA along with price. Then, the risk will be minimal, and the reward substantially great.

But also, the cost to the economy.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish talks with CNBC Asia about hope, fear, and greed, and what could happen going forward.

On the Thursday edition of StockCharts TV’s Your Daily Five, Mish walks you through where we are in the economic cycle at the end of the first quarter, then highlights what to look for (and trade) as we enter the second quarter.

In this appearance on CMC Markets, Mish gives you clear actionable information to support why commodities look to go higher from here.

Mish talks looking for stock market opportunities on Business First AM.

Mish discusses long bonds, Silver to Gold and the Dollar in this appearance on BNN Bloomberg.

Mish sits down with Kristen on Cheddar TV’s closing bell to talk what Gold is saying and more.

Mish and Dave Keller of StockCharts look at longer term charts and discuss action plans on the Thursday, March 17 edition of StockCharts TV’s The Final Bar.

Mish covers current market conditions strengths and weaknesses in this appearance on CMC Markets.

Mish sees opportunity in Vietnam, is trading SPX as a range, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole discuss specific stock recommendations and Fed expectations on TD Ameritrade.

Coming Up:

April 4th: The RoShowPod with Rosanna Prestia

April 24-26: Mish at The Money Show in Las Vegas

May 2-5: StockCharts TV Market Outlook

ETF Summary

S&P 500 (SPY): 405-410 back in focus.Russell 2000 (IWM): 170 support, 180 resistance still.Dow (DIA): Needs a second close over 332.Nasdaq (QQQ): 329 the 23-month moving average–huge.Regional Banks (KRE): Weekly price action more inside the range of the last 2 weeks–still looks weak.Semiconductors (SMH): And she’s off–255 key support, 270 resistance.Transportation (IYT): Cleared the weekly moving average, so now has to hold 225.Biotechnology (IBB): Good performance but not enough yet, unless clears 130 area.Retail (XRT): Ran right to big resistance at 64.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education