HOLLYWOOD, Fla. – Tennis legend Andre Agassi, 52, cannot wait to incorporate pickleball into his workout routine.

John McEnroe, 64, might feel otherwise after a weekend of pickleball events.

Along with Andy Roddick, 40, and Michael Chang, 51, the former tennis legends shined in a new sport during the first Pickleball Slam broadcast by ESPN on Sunday.

Agassi and Roddick earned a $1 million purse after beating McEnroe and Chang in a winner-take-all doubles match 21-15, 21-23, 12-10. Earlier McEnroe beat Agassi 15-13, 16-14, while Roddick cruised by Chang 15-10, 15-10 during singles matches at the Seminole Hard Rock Hotel & Casino.

“I think it was a shot in the arm for us as old fogies that were on the tennis court, getting a chance to come with some crowd and energy that doesn’t happen too much anymore,” McEnroe told USA TODAY Sports.

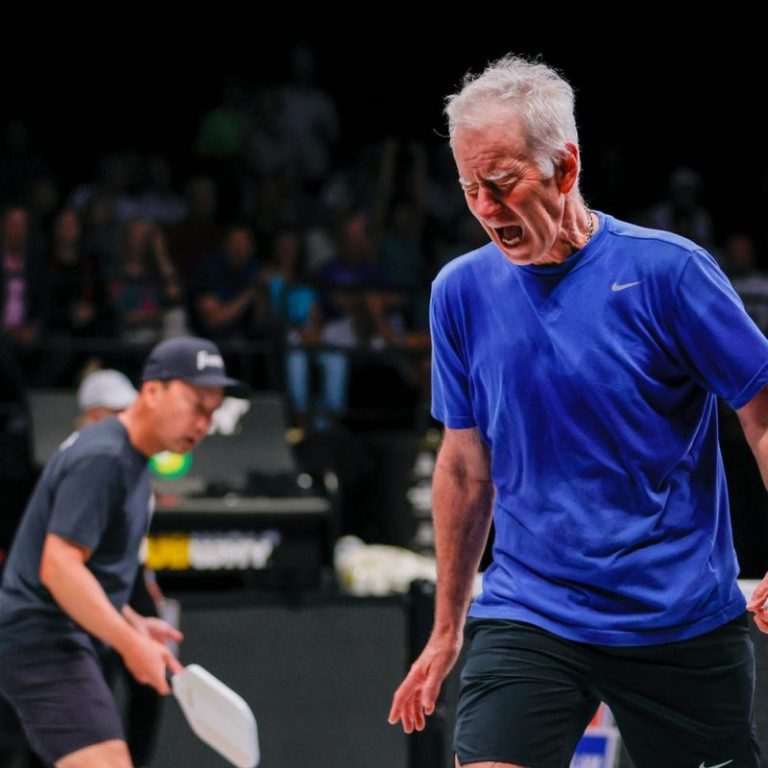

McEnroe was the star of the show, engaging with the fans in attendance after a big point, while throwing his paddle on the court several times and raising his arms up in disgust and dismay. He was on the unfortunate end of the last two points, allowing Agassi and Roddick to win.

“I got so into it,” Agassi told USA TODAY Sports.

“You’re doing something you have no familiarity with, so it just begs for total focus, and you focus too much and you lose perspective. So, it just got the energy going. It got the nerves going. It came together and it was fun. It was a blast for everybody.”

Here are some highlights from the event:

McEnroe brings the theatre and competition

It didn’t take long for McEnroe to throw his racket in the air, raise his hand to the heavens, issue two challenges, and even take a point off the board in favor of Agassi during the first set.

Agassi argued the referee didn’t recite the score out loud before the serve, but McEnroe served and won the point, which would’ve given him a 14-12 lead.

“She called it, man!” McEnroe shouted to Agassi.

“I did call the score,” the referee said.

“It’s the first argument I was won in 40 years,’ McEnroe said. “But I don’t feel right because he wasn’t playing the rally.”

So, the point came off the board.

“I’ve never seen this side,” Agassi said to McEnroe as they resumed play.

It was the first of many interactions between the tennis legends to the enjoyment of fans in attendance and viewers at home.

“John’s tremendous at delivering the theatre, and I think early on his outbursts were theatrical and later on they were authentic,” ESPN play-by-play announcer Chris Fowler said.

“You knew the competitive juices between these four guys, who do not like to lose at anything ever, were going to take over.”

Steffi Graf joins the fun

Graf, a tennis legend in her own right with 22 Grand Slam singles titles, received a loud ovation from fans as she was being interviewed by ESPN.

The ovation motivated McEnroe to interrupt the interview, and give her a paddle to play a point during the doubles match.

“That was a big surprise. I wasn’t filled into that part,” Graf said.

“It’s just fun. We’ve been enjoying it as a family and to see that sport grow and find a lot of new fans, it’s just been good.”

Graf traded volleys with both Agassi, her husband, and Roddick as Chang stepped to the side, while McEnroe went to the nearby bench to rest.

Agassi hit the net on the volley, earning Graf the point and another ovation.

“Steffi is a legend,” McEnroe said. “It just seemed like a good idea so I could stretch a little while she was playing. It’s called a free timeout.’

McEnroe, Roddick have trouble in the kitchen

It was only natural for the tennis stars to struggle with the non-volley zone, also known as the kitchen, on the pickleball courts. Players are not allowed to step into the squared off area closest to the net where they can commit foot faults.

Roddick’s paddle hit the area during his singles match with Chang, to which he screamed toward the referee:

“I got to pay attention to my feet and this thing?!” Roddick said.

“Maybe we should’ve had a meeting about this,” Roddick pleaded with the referee.

“I didn’t have time to tell you all the rules,” the referee said.

McEnroe also showed his dismay several times when his foot was caught over the NVZ line during both matches. But when Roddick was called for a foot fault during the second set of their doubles match, McEnroe was pleased.

“Great call,” McEnroe told the referee.

Final match brought the nerves and fun

The final set in the doubles match was a race to 11, and it brought the intensity out of all four legends.

McEnroe and Chang led until Agassi hit a wicked volley that screamed past McEnroe to tie the set at 9.

Agassi and Roddick took 10-9 lead, before McEnroe waved off Chang on the next point to tie it at 10.

McEnroe hit the net on his return to go down 11-10, and hit the pickleball out to give Agassi and Roddick the match and purse.

“Game!” Roddick screamed as he celebrated with Agassi.

“These guys have played in a whole lot of major finals, and you saw some nerves come onto them because this sport is not second nature to them,’ Fowler said.

“With the whole thing coming down to a couple of points, they didn’t want to be the guys to blow it for their whole team.”

Deion Sanders, Pat McAfee tune in from home

Count Colorado football coach Deion Sanders and radio host Pat McAfee, fresh off an appearance at WrestleMania, among many who tuned in on ESPN.

Attracting a wide audience both in attendance and from home was the goal for event organizers David Levy and Chris Weil, co-CEO of Horizon Sports & Experiences, and Jon Venison, who owns InsideOut Sports & Entertainment.

“I think we just showcased the best four racket players in the world playing the new, fastest growing sport,” Levy said.

The Pickleball Slam was the first of a five-event deal with Hard Rock, and organizers hope the participants will play again.

“I can tell you 100 percent, pickleball is part of my life,” Agassi said. “That doesn’t mean I want to go and compete in tournaments. But I’m telling you it’s something I’m going to do easily on a weekly basis for exercise, and spending time with friends. It’s the best.”

As for McEnroe, he may give it a shot again.

“It would have been easy to say yes if I had won, but we were close,” McEnroe said in his classic deadpanned nature. “I sort of feel like I’d like to try it one more time at least because I was so close.”

This post appeared first on USA TODAY