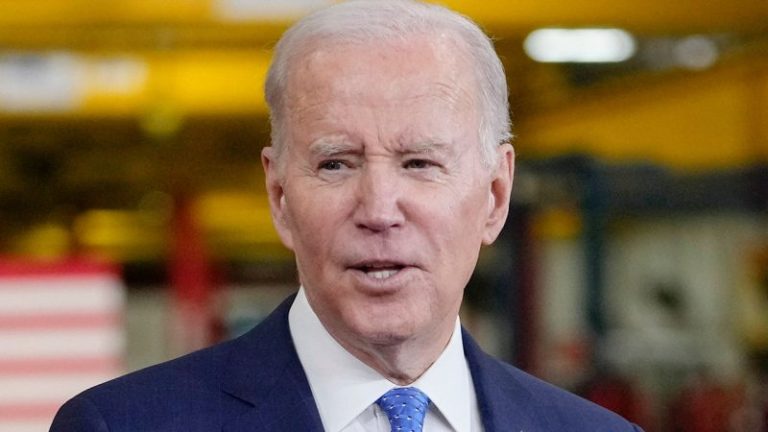

Several Republican politicians are criticizing the White House after it issued a long-awaited report on how the Biden administration handled the withdrawal from Afghanistan, but shifted the blame to the Trump administration.

The 12-page report released by the White House defends Biden’s decision to withdraw U.S. troops from Afghanistan, calling it the ‘right thing for the country.’

When discussing the Biden administration’s execution of the withdrawal from Afghanistan, the report pins the blame on the previous administration. The report does acknowledge that the evacuation, however, should have begun sooner.

‘President Biden’s choices for how to execute a withdrawal from Afghanistan were severely constrained by conditions created by his predecessor. When President Trump took office in 2017, there were more than 10,000 troops in Afghanistan. Eighteen months later, after introducing more than 3,000 additional troops just to maintain the stalemate, President Trump ordered direct talks with the Taliban without consulting with our allies and partners or allowing the Afghan government at the negotiating table,’ the report states.

While efforts were underway to withdraw Americans and allies from Afghanistan, 13 American soldiers died in a suicide bombing outside the Abbey Gate at Hamid Karzai International.

READ THE WHITE HOUSE REVIEW BELOW. APP USERS, CLICK HERE

During a press briefing on Thursday, White House National Security Council spokesman John Kirby said that the lack of planning by the Trump administration made the withdrawal difficult.

‘While it was always the president’s intent to end that war, it is also undeniable that decisions made and the lack of planning done by the previous administration significantly limited options available to him,’ Kirby said.

‘President Biden inherited a force presence in Afghanistan of some 2,500 troops. That was the lowest since 2001. He inherited a special immigrant visa program that had been starved of resources. And he inherited a deal struck between the previous administration and the Taliban that called for the complete removal of all U.S. troops by May of 2021, or else the Taliban, which had stopped its attacks while the deal was in place, would go back to war against the United States,’ Kirby said.

House Foreign Affairs Committee Chairman Rep. Michael McCaul, R-Texas, criticized Kirby for the comments.

‘John Kirby’s comments during today’s White House press briefing were disgraceful and insulting. President Biden made the decision to withdraw and even picked the exact date; he is responsible for the massive failures in planning and execution,’ McCaul said. ‘It is also unfortunate it took my subpoena threat to prompt the administration to finally provide the classified after-action reports from the Afghanistan withdrawal. I look forward to reviewing the report and call upon the administration to declassify as much as possible for the American public.

‘Finally, Congress must be given access to the full and complete record of documents from the withdrawal in order to get the answers on why the withdrawal was such a disaster.’

Sen. Steve Daines, R-Mont., said in a statement that the Biden administration isn’t taking responsibility for the withdrawal.

‘Once again the Biden administration is refusing to take responsibility for its failures and is destined to repeat them. President Biden’s weakness on the world stage cost 13 American lives and is putting our national security at risk — he must be held accountable,’ Daines said.

On Twitter, Rep. Ronny Jackson, R-Texas, called Kirby’s comments ‘sickening.’

‘Today White House spokesman John Kirby said he, ‘didn’t see’ chaos in the Afghanistan withdrawal. SERIOUSLY!? He’s the new ‘Baghdad Bob!’ Did he not see people hanging onto a C17 and falling to their deaths? REALLY!? He should tell this to the families of the 13 brave service members who lost their lives,’ Jackson tweeted.

Rep. Mark Green, R-Tenn., tweeted Kirby is ‘utterly detached from reality.’

’13 U.S. servicemembers were killed. Americans were left behind. This admin abandoned our allies to face the wrath of terrorists. The Biden admin is an embarrassment to this nation, to our military, and our allies across the world,’ he tweeted.

Fox News Digital reached out to the White House for comment.

Fox News’ Chris Pandolfo contributed to this report.