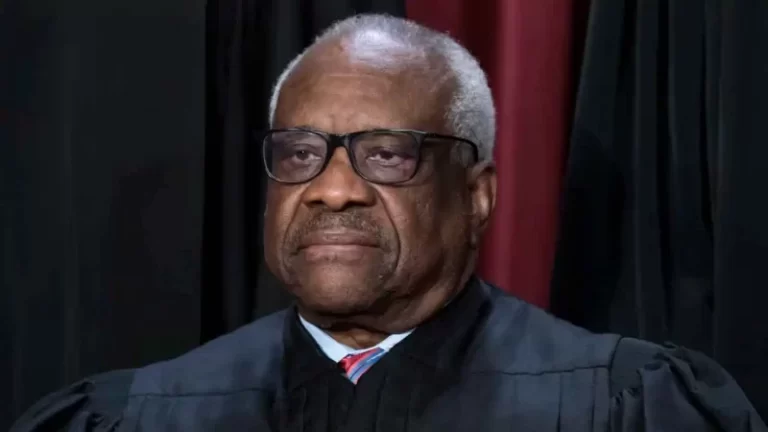

A report released last week accusing Supreme Court Justice Clarence Thomas of improperly receiving lavish gifts from a wealthy friend is nothing more than a political hit job, one expert claimed.

‘This is just grasping at straws by the left that is desperate to tear down Justice Thomas because he now has a working originalist majority on the court,’ said Roger Severino, vice president of domestic policy and The Joseph C. and Elizabeth A. Anderlik Fellow at The Heritage Foundation.

‘This is politics. Plain and simple.’

Severino’s comments to Fox News Digital came in response to a ProPublica report on Thursday accusing Thomas of improperly receiving lavish vacations from Republican mega donor Harlan Crow.

The ProPublica report accuses Thomas of taking trips across the world on Crow’s yacht and private jet without disclosing them and Crow acknowledged extending ‘hospitality’ to Thomas but insisted he never asked for it and that the two families have been friends for decades.

The ProPublica report claimed that trips taken by Thomas ‘have no known precedent in the modern history of the U.S. Supreme Court,’ which Severino, a Harvard Law graduate, flatly rejected.

‘There is no ‘there’ there because the justices have received gifts of hospitality from friends forever,’ Severino said. ‘And many of the justices have taken far more trips than Justice Thomas on somebody else’s dime, including Justice Breyer, who we know has taken at least 233 trips when he was on the bench.’

Severino explained that justices are permitted to accept invites to properties of friends for dinner or vacations without paying for it or disclosing it.

‘There’s nothing to see here because there’s been no allegation whatsoever that accepting travel to a friend’s property somehow influenced Justice Thomas’s decision-making,’ Severino said. ‘That’s absurd. If you know anything about Justice Thomas, it’s that he’s not influenced by outside pressures one whit. He’s guided by the law and the Constitution. Period.’

Severino accused liberals of giving a ‘pass’ to perceived bias on the left, pointing out that the late Justice Ruth Bader Ginsburg officiated a same-sex wedding before the Obergefell decision that federally recognized gay marriage.

‘Did that perhaps indicate bias where she should have recused herself?’ Severino asked. ‘The media was fairly silent about that and that sort of thing is much closer to the heart of impropriety in judging.’

Justices are not required to disclose invitations and travel that are considered ‘personal hospitality’ and the Supreme Court is not subject to an ethics code.

The Washington Post reported that the Judicial Conference, the policymaking body of the court, decided last month that judges must report travel by private jet, which Severino says is further proof Thomas was abiding by the rules.

‘It actually further reinforces the fact that he’d been acting within the rules and according to the practice that has been understood for decades,’ said Severino, who served from 2017-21 as director for the U.S. Department Health and Human Services Office for Civil Rights where he oversaw compliance with ethical rules including those regarding gifts.

‘Hospitality includes when somebody picks you up to take you to their house or to their property. That’s what hospitality is. It just happened to be a friend that has made it in the world that’s been quite successful, doesn’t change the fact that he’s a friend.’

Constitutional law professor and Fox News contributor Jonathan Turley told Fox News Digital that until recently, ‘even lower court judges were not required to report such trips under a personal hospitality exception.’

‘Justice Thomas would not have been required to report the trips under the prior rule,’ Turley said. ‘Once again, the Democrats and the media appear to be engaging in the same hair-triggered responses to any story related to Thomas. This includes the clearly absurd call for an impeachment by Rep. Alexandria Ocasio-Cortez.’

In terms of the ProPublica implication that Thomas’s relationship with Crow somehow affected his rulings from the bench, Severino said, ‘Nobody with a straight face can say Justice Thomas has been influenced by anybody except by the Constitution and his best reading of it.’

Many liberals on social media referred to the ProPublica report as a ‘bombshell’ and some called for a resignation.

At the same time, conservatives on Twitter echoed Severino’s conclusion that there is no ‘there there’ with the report.

‘Laughably stupid,’ author Dinesh D’Souza wrote. ‘He vacations with a rich friend, who also pays for dinner! Is this the best they’ve got? Clarence Thomas’ real offense is being black and conservative.’

‘I read the latest high tech lynching of Clarence Thomas for going on vacation with his rich friend,’ conservative communications director Greg Price tweeted. ‘I also read the disclosure laws for judges linked in the story that says they don’t have to report gifts from personal friends. ProPublica mysteriously left that out of their story.’

The ProPublica article cited multiple experts who blasted Thomas’ actions, including a retired judge appointed by former President Bill Clinton who called the justice’s actions ‘incomprehensible.’

Other experts, including legal ethics expert Stephen Gillers at NYU School of Law, adopted a tone more similar to Severino’s.

‘Justice Thomas could plausibly claim, and I think has claimed (as have others) that so long as an invitation itself came from a ‘person,’ not a corporation or business entity, it was ‘personal hospitality’ and he did not need to report it,’ Gillers told the Washington Post.

On Friday, Thomas released a lengthy statement saying just that.

‘Harlan and Kathy Crow are among our dearest friends, and we have been friends for over twenty-five years,’ Thomas said in a statement. ‘As friends do, we have joined them on a number of family trips during the more than quarter century we have known them.

‘Early in my tenure at the Court, I sought guidance from my colleagues and others in the judiciary, and was advised that this sort of personal hospitality from close personal friends, who did not have business before the Court, was not reportable. I have endeavored to follow that counsel throughout my tenure, and have always sought to comply with the disclosure guidelines.’

Thomas acknowledged that the guidelines were changed last month and it is his ‘intent to follow this guidance in the future.’

Turley told Fox News Digital that Thomas was ‘right to release a public statement.’

‘Justices have long been guests of private hosts,’ Turley said. ‘They are allowed to have friends and accept their hospitality. There is no evidence that Crow had business before the court. Nevertheless, expensive gifts or benefits should be disclosed, in my view, in the interests of court integrity.’

‘I have also long argued for a code of ethics that applies to the court. The question is where to draw the line so that judges are not constantly forced to treat every friend like a lobbyist or influence seeker.’