I remain quite bullish the overall market. I call what I see and what I saw in 2022 were stock market participants that turned incredibly bearish. I said at the beginning of 2022 that we needed a bear market brutal enough to send the masses to the sidelines and never wanting to own another stock – ever. Unfortunately, that’s what it takes. And the reason why we’ll continue going higher now is that no one believes we can. Here was a headline from CNBC last week:

Only 24% say now is a good time to invest in stocks, the lowest reading in the survey’s 17-year history. Perfect! Sentiment is a contrarian indicator and seeing this survey at an all-time low, even lower than during the financial crisis in 2008, tells me that everyone has sold and there’s a ton of money on the sideline to carry the stock market higher and higher.

Sentiment was incredibly bullish at the end of 2021. The equity-only put-call ratios ($CPCE) told us that retail traders were buying calls over puts by the fistful. We needed sentiment to “reset” and we’ve seen that on the CPCE. You can see from the headline above that pessimism is now at an extreme level, which will only add more fuel to the bullish fire.

How To Benefit From Higher Market Prices

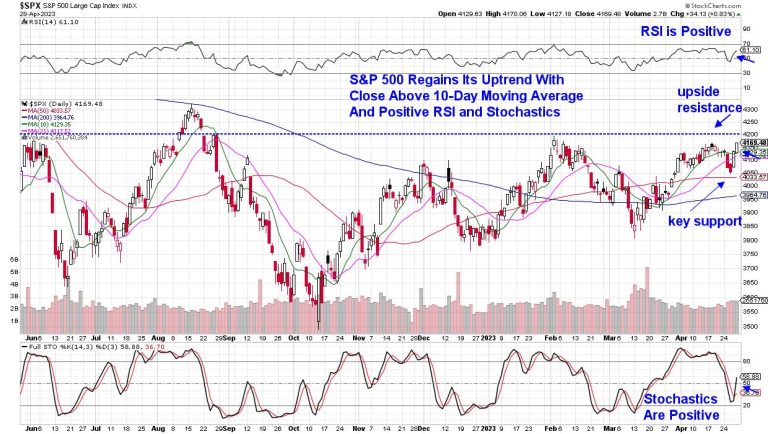

I’ve told EarningsBeats.com members since the June 2022 bottom that market risk had shifted. It became too risky to remain on the short side and that moving to long positions carried much less risk. I suggested that ETFs like the SPY and QQQ were excellent choices to simply benefit from market strength. Many non-EB members scoffed at such bullishness, unfortunately, as the S&P 500 and NASDAQ 100 are now higher by 14.64% and 20.01%, respectively. Much to the chagrin of bears, we’re going a lot higher. Fight it at your own peril.

Individual stocks have, in my opinion, been much more difficult, because of the insane rotation that’s been a big part of the market since 2020. There’s always been rotation in the stock market, but it’s been the severity and suddenness that’s made it especially difficult in recent years. I’ve chosen mostly ETFs to profit from the inevitable rally, realizing the rotation risk that made individual stock trading very difficult. Even now, I pick my spots for individual stocks.

Finding High-Reward-To-Low-Risk Setups

Given the rapid rotation, you must be willing to accept periodic losses. That’s the case in any market, but it’s especially true right now. Trading isn’t always butterflies and cotton candy. The trading winds seem to change on a dime, so you’ll need to be extremely nimble if trading individual stocks. I’ll leave that decision up to you.

I am trading by my bull market rules, expecting pullbacks to be bought, while potentially taking profits at key price resistance. I’ll give you three individual stocks that I like right now, along with one leveraged ETF that makes sense as well.

RLI:

I love to trade earnings gaps. When a stock gaps up at the opening bell, market makers provide liquidity by shorting. That usually results in stocks moving opposite the gap, once we see the opening bell. When stocks gap higher and keep moving higher, it’s a signal to me of very strong demand. In those cases, I generally like buying at the top of gap support. RLI also has its 20-day EMA rising and just beneath this gap support. Entry from the current price down to 137-138 makes good trading sense to me. A close beneath the 20-day EMA would represent a potential exit, so perhaps 1-2% risk. I’d look for a recovery back to recent highs, so there’s potential here for a 7-8% gain. That’s at least 4 to 1 in terms of reward to risk, which I find attractive.

ROK:

ROK was a clear leader in industrial machinery ($DJUSFE) and the group was performing extremely well through mid-March. The group saw its relative strength drop at that point and ROK fell into a bullish wedge after profit taking ensued. All of this followed a negative divergence (slowing momentum) printed. Throw in the false breakout and reversing bearish engulfing candle, and it was time for a pause in the ROK rally. On Thursday, ROK gapped higher on better-than-expected revenues and EPS when its quarterly results were announced. The opening gap cleared resistance in its bullish wedge. I expect ROK to now uptrend and eventually test its 306 price resistance level. To the downside, ROK’s 20-day EMA is at 278.58. As long as it closes above that rising EMA, I’d be okay holding. Therefore, the upside is roughly 22 bucks and the downside is approximately 5-6 bucks. This sets up with a very nice 4 to 1 reward-to-risk ratio.

SOXL:

I love the recent selling in the Dow Jones U.S. Semiconductor Index ($DJUSSC) to a critical price support zone. This is the time, in my opinion, to take on additional risk, in the form of leverage. First, check out the chart on the DJUSSC:

The DJUSSC not only tested trendline support from the October and December bottoms, but it also tested a critical area of price support from 7200-7400. That is THE PERFECT time to consider leverage, because if we see a breakdown, you can exit quickly, losing only a small portion on the leveraged bet. But what if this marks a major turning point on the chart and semiconductors lead the stock market much higher? Jumping in on a leveraged product will enhance your return considerably. It’s why I bought the SOXL and sent this out as a potential trade to EarningsBeats.com members on Friday. Leverage must be used wisely. There’s no guarantee that SOXL will make a major move higher, but this is the most critical level on the DJUSSC chart right now. It’s all about managing risk, not being right all the time. That’s why I use technical analysis – to help me manage risk. Those who don’t believe in technical analysis will simply point out that it doesn’t work all the time and, therefore, ignore. Poor souls.

Tomorrow morning, I’ll provide my third and favorite stock trade set up of all in our EB Digest newsletter. It’s free and there’s no credit card required. If you’d like to stay on the right side of the market and receive tomorrow’s trade setup, simply enter your name and email address HERE. We’ll get your free subscription started and take care of the rest!

Happy trading!

Tom