HONG KONG — After three years of trying to do business under some of the toughest Covid controls in the world, U.S. and other Western companies in China began 2023 with cautious optimism: The country was finally reopening and Chinese officials, eager to reinvigorate the economy, were actively courting overseas investors.

But a series of raids this spring on international consulting firms and other actions by Chinese authorities have undermined that message, reinforcing Beijing’s reputation as an increasingly unpredictable regime that poses growing risks for foreign commerce and investment, U.S. business groups and executives say.

The recent moves, coupled with ongoing diplomatic tensions with Washington, have further complicated the business environment between the world’s two largest economies even as they remain closely intertwined.

“What you’re seeing is a leadership that is — notwithstanding the rhetoric of, ‘We’re open, we’re back, we want foreign investment’ — that is just piling uncertainty on top of uncertainty. And the results of that, I think, are pretty predictable,” said a senior business executive who speaks regularly with U.S. officials and corporate leaders operating in China.

“When you create a more uncertain, less welcoming environment, business is going to vote with its feet,” said the executive, who spoke on the condition of anonymity out of concern that his comments could jeopardize his organization’s prospects in the country.

China is still a major focus for U.S. businesses, as evidenced by the recent stream of senior executives visiting for the first time since before the pandemic, including Apple CEO Tim Cook, JPMorgan CEO Jamie Dimon and Tesla CEO Elon Musk. And most American companies operating there intend to stay, with three-quarters of respondents in an April flash survey by the American Chamber of Commerce in China (AmCham China) saying they were not relocating their supply chains.

But China is no longer seen as a top-three investment market by a majority of U.S. companies, according to a business climate survey the chamber released in March. It was the first time in the poll’s 25-year history that member companies took such a pessimistic view of the Chinese market.

The survey showed that while American firms still see China as a priority, “their willingness to increase investment and strategic priority is declining,” the business group said.

By far the biggest concern for U.S. companies in China is the deteriorating relationship between the two countries, with 87% of respondents expressing a negative outlook in the flash survey.

Dozens of U.S. businesses have moved their regional headquarters out of the Chinese “special administrative region” of Hong Kong over the past decade, according to an Atlantic Council report in March. The trend accelerated sharply in 2021 and 2022 following China’s crackdown on mass pro-democracy demonstrations there, including sweeping legislation that has curtailed civil liberties.

FedEx said in May that it was shifting some of its Asia-Pacific operations from Hong Kong to Singapore, which has sought to take advantage of the changing business climate. A spokesperson said the carrier’s move would help “connect all of our operations in this region with greater speed and agility.”

A FedEx exhibition booth in Shanghai last year. The package carrier is among the Western companies shifting some of their regional operations away from Hong Kong.VCG via Getty Images

At a JPMorgan summit of American and Chinese business leaders in Shanghai last week, Dimon called for “real engagement” between the U.S. and China on security and trade issues, Reuters reported. He also expressed support for the Biden administration’s policy of “de-risking” the U.S. relationship with China rather than a more serious “decoupling.”

Musk, who has a major Tesla factory in Shanghai, likewise voiced opposition to decoupling in a meeting in Beijing last week with Chinese Foreign Affairs Minister Qin Gang, according to a readout from the Foreign Affairs Ministry.

While Musk has not commented publicly on his trip, Chinese state media held up his visit as a sign of Beijing’s openness to foreign investment.

“China is firmly committed to advancing high-level opening up and fostering a market-oriented, law-based and internationalized business environment,” Chinese Foreign Affairs Ministry spokesperson Mao Ning said at a regular news briefing in Beijing last week. “We welcome foreign companies to invest and do business in China, explore the Chinese market and share in development opportunities.”

But the foreign business community has been rattled this year by a series of raids and heightened scrutiny of international consulting companies, financial auditing firms and law offices that conduct due diligence on investments and new ventures in China. Chinese authorities cited national security concerns for some of the moves.

A spokesperson for the U.S. corporate due diligence firm Mintz Group confirmed that Chinese authorities in March had detained five staff members at its Beijing office, all of them Chinese nationals, and closed its operations there. The company has not received any official legal notice regarding a case against it and has requested that its employees be released, the spokesperson added.

A spokesperson for the U.S. consulting firm Bain & Co. confirmed that Chinese authorities had questioned staff at its Shanghai office in April and said it was cooperating as appropriate.

Chinese state media reported in May that national security authorities had investigated Capvision Partners, a consulting firm that puts clients in touch with mostly Chinese experts in various fields and has headquarters in Shanghai and New York. The firm, which didn’t respond to a request for comment, said in an earlier statement on its WeChat account that it would abide by China’s national security rules.

Business groups have raised concerns over the types of firms China has targeted, saying their services are crucial to establishing investor confidence in any market.

“If you can’t collect information, how can you run and manage your business?” said Michael Hart, president of AmCham China. “How can you plan future investment if you can’t do due diligence on your future partners?”

Adding to the uncertainty, Hart said, is the lack of reason given for the law enforcement actions.

“On the one hand, China says it wants FDI,” he said, referring to foreign direct investment. “But for the companies who are focused on China trying to collect information, there seem to be restrictions, and the really concerning thing is it’s not clear to us where that line is.”

Foreign companies have also been unnerved by heightened restrictions on access to commercial information and a recent expansion of China’s anti-espionage law that the U.S.-China Business Council said “casts a wide net over the range of documents, data or materials considered relevant to national security.”

There seem to be restrictions, and the really concerning thing is it’s not clear to us where that line is.

Michael Hart, president of AmCham China

While national security has long been central to both U.S. and Chinese policy decisions affecting business, Beijing has also cited those concerns to justify moves widely seen abroad as acts of state repression, such as the Hong Kong crackdown and the mass surveillance and internment of Uyghurs in the Xinjiang region.

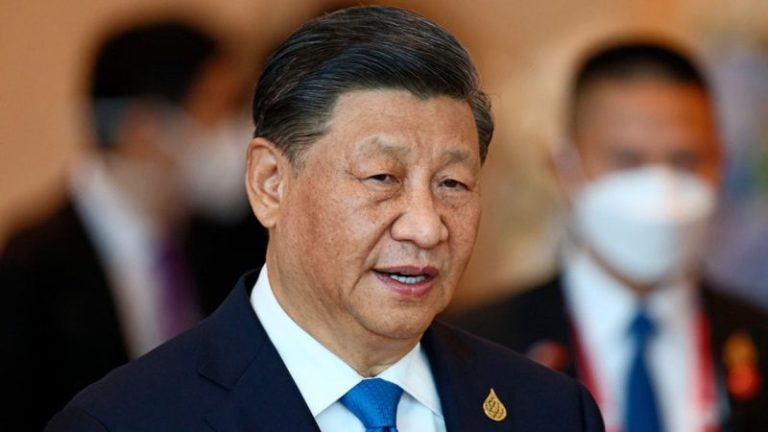

At a meeting in Beijing last week, Chinese President Xi Jinping, who accuses the U.S. of trying to block China’s development, called for heightened national security measures and said the government should be prepared for “worst-case” scenarios, according to Xinhua, China’s state-run news agency.

“It was stressed at the meeting that the complexity and severity of national security problems faced by our country have increased dramatically,” the agency said.

In Washington, Republicans and Democrats alike have been debating a ban on the Chinese-owned social media app TikTok, citing national security concerns among other factors. Semiconductor chips have also become a growing flashpoint between the two economic superpowers.

Last year, the Biden administration imposed export controls intended to cut China off from chips and other strategically important technologies. It is also considering new restrictions on U.S. investment in Chinese companies working on advanced semiconductors, artificial intelligence and quantum computing, according to congressional testimony last month.

In May, in what was widely seen as retaliation against the export controls, Chinese regulators barred operators of key infrastructure from buying products from U.S. chipmaker Micron, saying it had failed a network security review.

U.S. Commerce Secretary Gina Raimondo described the move as “plain and simple economic coercion.” Mao, the Foreign Affairs Ministry spokesperson, in turn accused the U.S. of economic coercion over restrictions it has placed on more than 1,200 Chinese companies and individuals “despite the lack of hard evidence of wrongdoing.”

The U.S. executive said while it has been clear for some time that a foreign company’s data is not secure in China, firms now must also worry about whether their employees will be questioned by state security or even jailed. Beijing’s widespread use of exit bans barring foreigners from leaving the country has also caused serious concerns for businesses, he said.

“Once you take these actions and undermine confidence, it’s not really clear how you restore that,” he said.

This post appeared first on NBC NEWS