FIRST ON FOX: Sen. Ted Cruz, R-Texas, is spearheading a bicameral reintroduction of legislation that would jail illegal immigrants who repeatedly enter the U.S. after being deported – as the U.S. continues to tackle an ongoing migrant crisis at the border.

‘Kate’s Law,’ also called the Stop Illegal Reentry Act, was first introduced in 2015 and named after Kate Steinle, who died after being shot in 2015 by an illegal immigrant who had been deported multiple times and had prior convictions. He was ultimately acquitted of murder after arguing that the gun accidentally fired when he picked it up.

Cruz’s legislation was blocked by Democrats after its first introduction, but Cruz has continued to introduce the bill in each Congress. The bill would set a federal mandatory minimum of five years in prison for any illegal reentry offense.

Now it is being introduced again with a Republican-controlled House and a slim Democrat majority in the upper chamber, and it comes amid a broader push by Republicans and conservatives to implement tougher policies to prevent illegal entry, including more deportations and additional border security.

‘Eight years ago, when I first introduced Kate’s Law, I was just as shocked and dismayed that Kate Steinle was killed by an illegal felon who had reentered the U.S. as I am today,’ Cruz said in a statement to Fox News Digital on Wednesday. ‘Almost a decade has gone by since this shooting, and we have yet to strengthen federal law to prevent a tragedy like this from recurring.’

‘The first time this legislation was stopped by Senate Democrats, I vowed to continue fighting for Kate’s Law, and I am proud to introduce this legislation once again to prevent aggravated felons from preying on innocent Americans,’ he said.

The push comes as the U.S. is still dealing with more than 200,000 migrant encounters at the border each month. In fiscal year 2023 so far, there have been more than 1.6 million migrant encounters, after nearly 2.4 million in fiscal year 2022, which set a new record. In May, there were more than 204,000 migrant encounters.

Republicans have blamed the policies of the Biden administration for the surge, including more instances of ‘catch and release,’ the end of the Trump-era border wall construction, the end of the ‘Remain in Mexico’ policy and reduced interior enforcement.

The Biden administration has said it is working to fix an asylum system gutted by the Trump administration, and it has recently been touting a sharp drop in encounters since new policies were implemented – including an asylum ineligibility for some illegal immigrants – on May 11. It has also called for a comprehensive immigration reform bill to be passed in Congress, including more funding and a pathway to citizenship for illegal immigrants.

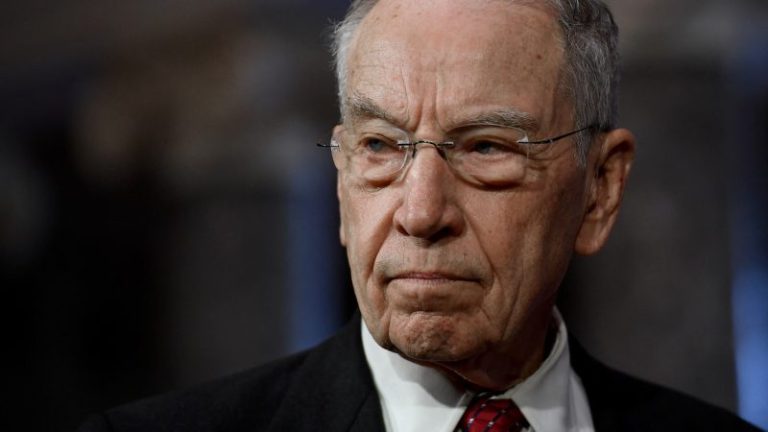

In the House, the push for the legislation is being led by Stephanie Bice, R-Okla. In the Senate, Sens. Tom Cotton, R-Ark., and Chuck Grassley, R-Iowa, are co-sponsoring the push with Cruz.

‘Earlier this year in Texas, an individual who had been deported four times killed five individuals, proving the extensive flaws in our immigration system,’ Bice said in a statement. ‘Under the Biden administration the southern border is completely out of control, with record-breaking crossings occurring every month. In Fiscal Year 2022, CBP arrested 12,028 individuals with criminal convictions. This legislation would impose tougher criminal penalties against illegal immigrants who have committed violent crimes, and those who illegally reenter the United States after previously being deported.’

Cotton said illegal immigrants who reenter after being deported ‘show a knowing and willful disregard for our laws.’

‘This bill will ensure that illegal aliens who return to the U.S. face serious prison time,’ he said.

The legislation is being introduced a day after new turnover was announced in the Department of Homeland Security’s staff. Deputy Secretary John Tien announced his retirement Tuesday after both Border Patrol Chief Raul Ortiz and Acting Immigration and Customs Enforcement Director Tae Johnson both said they will depart later this month.