On Thursday, the ADP jobs number came in much higher than expected, and annual pay rose at a 6.45% rate. The FOMC minutes earlier this week were tilting towards a hawkish bias. The strong jobs market and the hawkish comments spooked investors. Equity indexes dropped on fears that the Fed may raise interest rates.

But Friday was a different story. The non-farm payrolls increase of 209K in June came in lower than expected, alongside the slowest job growth since December 2020. The number is also well below May’s job creation, which is an indication of a slowing down in job creation. The unemployment rate was 3.6%, marginally lower than 3.7% in May.

The bottom line: Even though the labor market shows signs of modest cooling, the labor market is still hot.

What does this mean as far as interest rate hikes are concerned? The Fed is focused on the labor market. One month’s data doesn’t make a trend, but the general thinking is that the slowing in the job market may not be enough to convince the Fed to keep interest rates unchanged. The probability of a 25-basis point rate hike in the July 26 meeting, according to the CME FedWatch tool, is at 92.4% at the time of this writing.

The State of the Stock Market

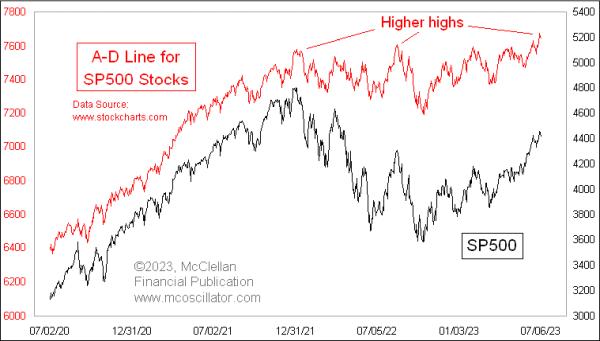

The S&P 500 index ($SPX) continued its uptrend, despite the selloff after investors became slightly nervous. The weekly chart below shows the index is still moving higher (higher highs and higher lows) and is on its way to its all-time high. The index has moved above its Fibonacci retracement levels. One resistance level it could hit is the March 2022 high; if it breaks through that, it would be very positive for the S&P 500.

CHART 1: WEEKLY CHART OF S&P 500 INDEX. The S&P 500 is approaching its all-time highs. It could face resistance on its way up. Chart source: StockCharts.com (click on chart for live version). For educational purposes.

The daily chart of the S&P 500 is also bullish. The index is trading above its 50-, 100-, and 200-day simple moving averages (SMA), all trending upward. Market breadth is also positive, with the percent of stocks trading above the 200-day SMA trending higher and more advances than declines.

CHART 2: DAILY CHART OF THE S&P 500 INDEX. The index is trading well above its 50-, 100-, and 200-day moving averages. The percentage of stocks trading above their 200-day SMA is trending higher but declines are greater than advances. Chart source: StockCharts.com (click on chart for live version). For educational purposes.

When a broad index looks overbought, there’s always the risk that it may experience significant declines on any bad news. When the regional banking crisis erupted in March, the index fell, retested its December 2022 lows, and bounced back. Although Technology stocks are the heavily-weighted stocks in the index, financial stocks are also represented. And with big banks on deck to report earnings next week, it’s worth analyzing the KBW Bank Index ($BKX).

KBW Bank Index ($BKX) Technical Outlook

Last month, the big banks passed their annual stress test, which was a welcome relief after the banking crisis in March. Wall St. will be closely watching earnings reported by the banks.

The banking sector took a hit after the banking crisis earlier this year. In light of higher interest rates and an inflationary environment, investors will be looking to see how banks with exposure to interest rates vs. banks with exposure to investment banking, trading, and wealth management will perform. Remember, even though higher interest rates can be profitable for banks, they also elevate the risk of a recession.

CHART 3: THE WEEKLY CHART OF THE KBW BANK INDEX IS STILL WELL BELOW ITS HIGHS. The index is trading well below its 50-, 100-, and 200-week moving averages and its relative strength with respect to the S&P 500 index is weak. Chart source: StockCharts.com (click on chart for live version). For educational purposes.

As you can see, $BKX is still down around 20% for the year. Its relative strength with respect to the S&P 500 index ($SPX) is deeply negative at -51.47%. The 50-, 100-, and 200-day week moving averages are trending lower and $BKX is trading well below these averages.

The daily chart of $BKX is a little more optimistic. At least the index has moved above its 50-day SMA. The index is also underperforming the S&P 500 on the daily timeframe. If $BKX moves to its 100-day SMA, it could hold well for the banking sector. It all depends on the upcoming earnings. JP Morgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) report on Friday.

CHART 4: THE BANKING SECTOR MAY SHOW SOME STRENGTH. On the daily chart, $BKX is showing some optimism. The index is trading above its 50-day SMA. Will upcoming bank earnings push this index higher? Banks start reporting on July 14. Chart source: StockCharts.com (click chart for live version). For educational purposes.

Stay on top of earnings season with the StockCharts Earnings Calendar. From Your Dashboard, scroll down the Member Tools section and click on Earnings Calendar. Click the Upcoming Earnings tab, filter using the dropdown menu, and identify which earnings will be announcing earnings.

Final Thoughts

With the S&P 500 close to its highs, investors and traders should tread with caution. The upcoming earnings season could have an impact on the performance of the broader market. Keep a close watch on potential support and resistance levels on your charts. Besides earnings, there’s a Fed meeting at the end of the month. Any scenario could play out and, while you can never be fully prepared for what the stock market throws at you, it’s worth anticipating the different scenarios that could play out.

End of Week Wrap Up

US equity indexes down; volatility down

$SPX down 0.29% at 4398.95, $INDU down 0.555 at 33734.88; $COMPQ down 0.13% at 13660.72$VIX down at 14.83Best performing sector for the week: Real EstateWorst performing sector for the week: Health CareTop 5 Large Cap SCTR stocks: SMCI, NVDA, CCL, TSLA, PLTR

On the Radar Next Week

Earnings season kicks off with big banks JP Morgan (JPM), Citigroup (C), and Wells Fargo (WFC) reporting on Friday, July 14.June CPIJune PPIJobless ClaimsFed speeches: Daly/Barr/Mester/Bostic/Bullard/Kashkari/WallerMichigan Consumer Sentiment

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.