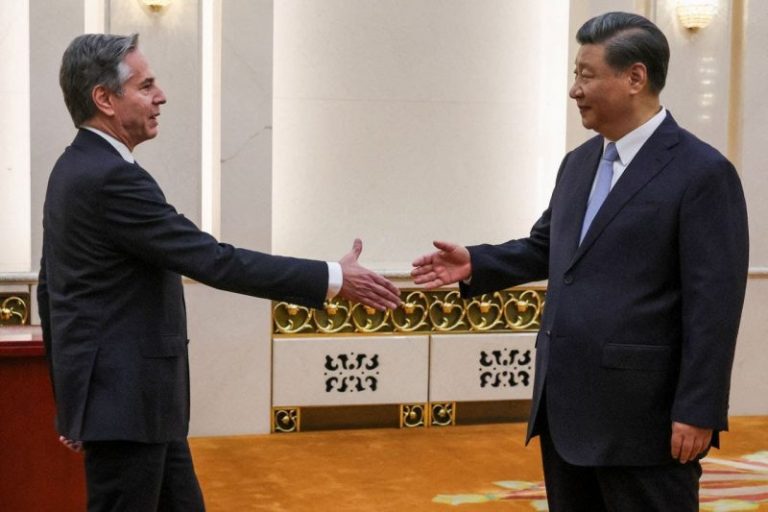

House Republican Conference Chair Elise Stefanik is renewing criticism of what she called an ‘unacceptable’ trip to China by Secretary of State Antony Blinken last month, after reports that the State Department discovered a hack into official emails just as Blinken was about to embark on the trip.

‘The State Department knew Communist China was carrying out an extensive hacking campaign to collect intelligence against the United States, yet Secretary Blinken still went to Beijing, legitimizing the CCP’s aggressive behaviors in the process,’ Stefanik, R-N.Y., said in a statement to Fox News Digital.

‘This is unacceptable and exactly why I called for the cancellation of Secretary Blinken’s trip,’ she said.

The New York Times reported that the State Department discovered a hack, which began in May, into the email accounts of Commerce Secretary Gina Raimondo as well as State Department officials before Blinken made the trip to Beijing — which had been delayed over the Chinese spy balloon incident in February. The Times reported that the State Department discovered the intrusion on June 16, the same day Blinken left from Washington, D.C., for the trip.

‘The Department of State detected anomalous activity, took immediate steps to secure our systems, and will continue to closely monitor and quickly respond to any further activity. As a matter of cybersecurity policy, we do not discuss details of our response and the incident remains under investigation,’ the department said this week in a statement.

‘The Department of State has a robust cybersecurity program to protect our systems and information and works continuously to build resilience and stay ahead of malicious actors. We continuously monitor our networks and update our security procedures.’

Officials said classified information was not accessed through the emails, The New York Times reported.

It marks the latest hostile action by the Chinese regime, which not only launched a spy balloon across the U.S. earlier this year, but has also sought to build spy bases in Cuba. It has also launched a widespread hacking campaign against the U.S. and other nations.

The intelligence community’s annual threat assessment stated that China represents the ‘broadest, most active, and persistent cyber espionage threat to U.S. Government and private-sector networks.’

Officials have warned that China is ‘capable of launching cyberattacks that could disrupt critical infrastructure services within the United States, including against oil and gas pipelines, and rail systems.’

Reuters reported that Blinken told China’s top diplomat this week that any action targeting the U.S. government, companies or citizens ‘is of deep concern to us, and that we will take appropriate action to hold those responsible accountable.’

But Republicans have criticized the Biden administration for what they see as a soft and dismissive approach to the threat from communist China as it seeks to create good relations with Beijing.

President Biden last month said that the balloon incident was ‘more embarrassing than it was intentional’ and said he hopes he could speak to President Xi Jinping about how the U.S. and Beijing could ‘get along.’

Stefanik doubled down on that criticism this week.

‘President Biden’s desire for a ‘thaw’ in relations with the CCP continues to be the incorrect approach,’ Stefanik said in her statement. ‘Instead, we must pursue peace through strength in order to deter further CCP aggression.’

Fox News’ Nicholas Kalman contributed to this report.