Do not go gentle into that good night,

Old age should burn and rave at close of day;

Rage, rage against the dying of the light. – Dylan Thomas

The time is short. There’s always a rush. And if you are a member of Congress, you are always on the clock.

Six years in the Senate. Two years in the House. The cycle is relentless.

Lawmakers are defeated, they retire or resign. Most of them lament that they never accomplished everything they wanted in office.

That’s not because they didn’t try. The political circumstances weren’t right. The issue hadn’t ripened yet. Their proposal got left out on the parliamentary cutting room floor.

But lawmakers always grumble. No matter how long they were in office, there simply wasn’t enough time.

Politicians generally are not shrinking violets. Otherwise, they wouldn’t have gotten into this business. They can be stubborn. Unwilling to be pushed around. Plus, as lawmakers grow older, they are sprinting against the dying of the political light – be it the length of their political terms or time on this mortal coil.

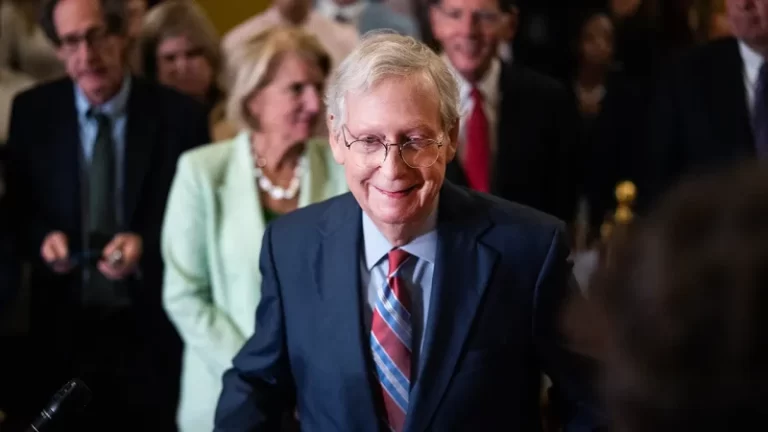

That’s why recent incidents involving 81-year-old Senate Minority Leader Mitch McConnell, R-Ky., and 90-year-old Sen. Dianne Feinstein, D-Calif., pose questions about whether age and health should be a factor in someone’s fitness to serve.

How long is too long?

They may be among the most powerful leaders in America. But they are no match for the great equalizers: health and age.

McConnell froze for nearly 20 seconds at the Senate GOP’s weekly press conference recently. Other Republican senators led the Kentucky Republican away before he returned a bit later to field questions from reporters.

Feinstein appeared addled at a recent Senate Appropriations Committee meeting. Feinstein began giving a speech at the meeting – even as the committee was voting on a specific proposal. An aide appeared to try to guide Feinstein.

‘I would like to support a ‘yes’ vote on this. It provides $823 billion…’ said Feinstein before Senate Appropriations Committee Chairwoman Patty Murray, D-Wash., interrupted.

‘Just say ‘aye,’’ coached Murray.

‘OK. Just ‘aye!’’ said Feinstein, with a laugh.

Age stalks 80-year-old President Biden. Republicans routinely question the president’s age and fitness for office – especially after he tripped over a sandbag while handing out diplomas at the Air Force Academy this spring. Mr. Biden also gave meandering remarks last month while meeting with Israeli President Isaac Herzog.

‘I think that it’s legitimate to discuss the age of the president who’s running for re-election,’ said Sen. Cynthia Lummis, R-Wyo.

To be fair, Lummis also mentioned that former President Trump – now the front-runner for the 2024 Republican presidential nomination – is not exactly a spring chicken at age 77.

The White House historically dismisses concerns about the age of the current commander in chief.

‘The age comment has been out there,’ said White House press secretary Karine Jean-Pierre. ‘And what has this president done? He beat Republicans in 2020. He beat Republicans in 2022.’

As for McConnell, there are stage whispers in the Senate’s marble corridors that the minority leader isn’t the same since missing six weeks earlier this year. McConnell suffered a concussion and cracked ribs after a tumble in the restroom of a Washington, D.C., hotel.

McConnell generally speaks more quietly and with a deep rumble since returning to the Senate after the accident.

‘He should tell us if something bigger is going on,’ said Sen. Kevin Cramer, R-N.D.

McConnell appeared over the weekend at the annual ‘Fancy Farm Picnic’ in southwestern Kentucky. The fete dates back to the late 19th century. The Bluegrass State’s political royalty from both sides gives speeches and chats with voters.

When McConnell spoke, Democrats in the crowd jeered the minority leader with chants of ‘Retire! Retire!’

McConnell observed this was his 28th appearance at the Fancy Farm soiree.

‘I want to assure you it’s not my last,’ said McConnell. ‘The people of this state have chosen me seven times to do this job. I want you to know how grateful I am.’

However, McConnell has also tripped and fallen on two other occasions this year.

That’s why Senate Republicans are tiptoeing around this delicate question surrounding McConnell, his health and whoever may eventually emerge as the leader of Senate Republicans.

‘I think he’ll know when the time is right,’ said Sen. Mike Braun, R-Ind., when asked about McConnell’s future.

These health episodes trigger subtle political jockeying among those who could prospectively succeed McConnell as the Senate GOP leader.

The focus is on the ‘three Johns.’ That’s Senate Minority Whip John Thune, R-S.D., Sen. John Barrasso, R-Wyo., and Sen. John Cornyn, R-Texas. All three have leadership chops. As GOP whip, Thune stepped into the void when McConnell was absent earlier this year. One source noted that before McConnell’s injury, his office handled almost all leadership issues. But even since McConnell’s return, Thune continues to tackle a handful of leadership responsibilities.

Barrasso currently serves as the Republican conference chair, the third-highest ranking GOP slot. Cornyn served as majority whip from 2015 through 2019.

A reporter asked Thune in late July if McConnell should seek the top leadership post in the next Congress.

‘The new Congress is 18 months away,’ replied Thune, pivoting immediately to another subject. ‘I’m trying to figure out how to get the defense authorization (bill) off the floor today.’

Such a response is common for those with leadership aspirations. They want to be talked about as in the running for whenever another leader moves on – for one reason or another. But they don’t want to talk themselves about pushing to get the leadership slot. It’s an artful dance to make yourself part of the conversation – yet simultaneously not appear as though you are shoving someone out the door.

That said, time is undefeated. Nearly half of all senators are now age 67 or older. And the time for all leaders is eventually up, one way or another.

For instance, former House Speaker Nancy Pelosi, D-Calif., remains in Congress as a rank and file member. But Pelosi ceded the speaker’s gavel in January at age 82. She turned 83 this past March.

‘I believe there should be a criteria of fitness to serve of cognitive testing or cognitive assessment,’ said Dr. Mark Siegel, a medical contributor to Fox. ‘That’s what the senators owe us and that’s what should be done.’

Siegel and others raised that issue after the election of Sen. John Fetterman, D-Pa., last year. Fetterman struggles to speak and has issues processing audio after a 2022 stroke. He often uses a tablet to communicate or help him digest oral questions. Fetterman took office in January, but almost immediately took medical leave from the Senate for depression.

Despite Fetterman’s issues with audio and speaking, there’s no evidence the senator has cognitive problems.

But here’s the constitutional issue with Siegel’s proposal.

Voters may be concerned about lawmakers who are older or suffer from visible health issues like McConnell and Feinstein. But imposing other qualifications for service may be out of bounds. Article I, Section 3 of the Constitution only lists three requirements for someone to serve in the Senate. Persons must be 30 years of age, a U.S. citizen and live in the state they represent at the time of the election.

The Senate has long seen many members hang around too long.

Former Senate Majority Leader Robert Byrd, D-W.Va., Strom Thurmond, R-S.C., and Thad Cochran, R-Miss., come to mind. Byrd stepped down as majority leader in the late 1980s – yet remained in the Senate until his death in 2010 at age 92. Thurmond was still a senator when he was 100.

Siegel says he counsels people who are older yet healthy to keep working as long as they can.

‘But the problem is that the last person to know that they’re no longer functioning is usually the person themselves,’ said Siegel.

Siegel also said it’s one thing to continue to serve as senator. But it’s another enterprise to shoulder official leadership responsibilities at an advanced age. That’s why Byrd and Pelosi stepped aside.

Before McConnell’s latest episode, multiple senators remarked how he rattled off facts and figures at the closed door lunch without notes.

‘He was at the top of his game,’ said one Republican senator.

However, another GOP senator told Fox McConnell didn’t appear well on the Senate floor the day before he froze.

So it’s hard to say when is when for anyone. But once elected, voters can’t do much about it if someone is infirm or in failing health.

After all, as Dylan Thomas wrote, lawmakers are fighting ‘against the dying of the light’ from the moment they’re sworn in. A six-year term. A two-year term. So much to do. So little time.

And that same mantra applies to the rest of us, too.

Whether we serve in Congress or not.