We do not want to walk down the political aisle. Nonetheless, what person can turn their heads away from the Sunday deadline on funding the government?

The aftermath of a shutdown will most likely include a credit downgrade for the US. Do Americans need another reason to distrust the politicos?

With a 90% consensus that the funding will not pass, the bounce we saw in equities last week could be short-lived.

The Retail ETF XRT had a technically perfect mean reversion in momentum and a classic glass bottom reversal. Coming into Friday, 3 of our risk gauges said risk neutral. That gave us hope that our Granny Retail could lead us out of harm’s way. And, on the heels of Nike earnings, she kinda did.

However, will a bounce in the consumer sector help keep the risk gauges neutral? For that answer, we turn to another old reliable friend, high yield, high debt junk bonds.

These bonds are a key influencer for risk; after all, how bad can things be if companies with junk ratings are being bought for their higher-paying yield? That is a big risk-on factor.

We also look at their performance relative to the long bonds (TLT). Even though neutral can turn to risk-off, any hope from bond traders and/or the retail sector could also see risk-neutral turn to risk-on. We can hope, right?

The chart of HYG has several fascinating and a somewhat taming influence on the extreme negativity. For starters, HYG held its ground on Friday as the indices turned red. (So did XRT, by the way.) Secondly, HYG returned over the July 6-month calendar range low (red horizontal line). Thirdly, HYG held the March lows made after the mini-banking crisis. Fourth, HYG had a mean reversion buy in our Real Motion momentum indicator.

Fifth, and here is the risk gauge ratio, HYG is strongly outperforming the TLT (Leadership indicator). That is what bulls need to continue to see. Conversely, bulls do not want to see HYG fail the March lows. Nor do they want to see XRT take out last week’s lows. Furthermore, they do not want to see TLT catch a bid in fear of an oncoming recession while junk bonds underperform.

We like it when we can simplify the narrative. Junk bonds help us to accomplish that.

This is for educational purposes only. Trading comes with risk.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

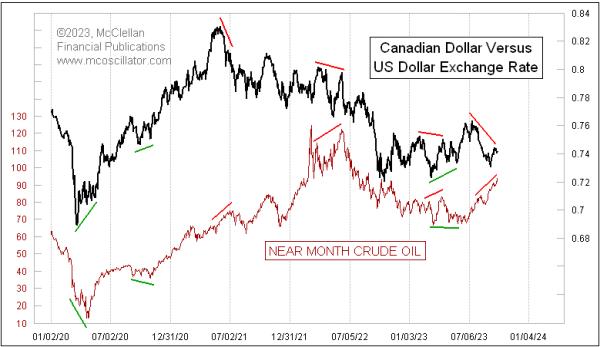

See Mish argus investors could jump into mega-tech over value and explain why she is keeping an eye on WTI prices on BNN Bloomberg’s Opening Bell.

Even as markets crumble, there are yet market opportunities to be found, as Mish discusses on Business First AM here.

Mish explains how she’s preparing for the next move in Equities and Commodities in this video with Benzinga’s team.

Mish talks about the head-and-shoulders top pattern for the S&P 500 in The Final Bar.

Mish covers sectors from the Economic Family, oil, and risk in this Yahoo! Finance video.

Mish shares why the most important ETFs to watch are Retailers (XRT) and Small Caps (IWM) in this appearance on the Thursday, September 20 edition of StockCharts TV’s The Final Bar with David Keller, and also explains MarketGauge’s latest plugin on the StockCharts ACP platform. Mish’s interview begins at 19:53.

Mish covers 7 stocks that are ripe for the picking on the Wednesday, September 20 edition of StockCharts TV’s Your Daily Five, and she gives you actionable levels to watch.

Take a look at this analysis of StockCharts.com’s Charting Forward from Jayanthi Gopalkrishnan, which breaks down Mish’s conversation with three other charting experts about the state of the market in Q3 and beyond.

Mish was interviewed by Kitco News for the article “Oil Prices Hit Nearly One-Year High as it Marches Towards $100”, available to read here.

Mish covers short term trading in DAX, OIL, NASDAQ, GOLD, and GAS in this second part of her appearance on CMC Markets.

Mish talks Coinbase in this video from Business First AM!

Mish looks at some sectors from the economic family, oil, and risk in this appearance on Yahoo Finance!

Mish covers oil, gold, gas and the dollar in this CMC Markets video.

In this appearance on Business First AM, Mish explains why she’s recommending TEVA, an Israeli pharmaceutical company outperforming the market-action plan.

As the stock market tries to shake off a slow summer, Mish joins Investing with IBD to explain how she avoids analysis paralysis using the six market phases and the economic modern family. This edition of the podcast takes a look at the warnings, the pockets of strength, and how to see the bigger picture.

Mish was the special guest in this edition of Traders Edge, hosted by Jim Iuorio and Bobby Iaccino!

In this Q3 edition of StockCharts TV’s Charting Forward 2023, Mish joins a panel run by David Keller and featuring Julius de Kempenaer (RRG Research & StockCharts.com) and Tom Bowley (EarningsBeats). In this unstructured conversation, the group shares notes and charts to highlight what they see as important considerations in today’s market environment.

Coming Up:

October 2: Schwab, The Watch List

October 4: Jim Puplava, Financial Sense

October 5: Yahoo! Finance

October 12: Dale Pinkert, F.A.C.E.

October 26: Schwab at the NYSE

October 27: Live in-studio with Charles Payne, Fox Business

October 29-31: The Money Show

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY): There are multiple timeframe support levels round 420-415.Russell 2000 (IWM): 170 huge.Dow (DIA): 334 pivotal.Nasdaq (QQQ): 330 possible if can’t get back above 365.Regional banks (KRE): 39.80 the July calendar range low.Semiconductors (SMH): 133 the 200-DMA with 147 pivotal resistance.Transportation (IYT): Could be another bright spot if clears 237. 225 support.Biotechnology (IBB): 120-125 range.Retail (XRT): 57 key support; if can climb over 63, get bullish.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education