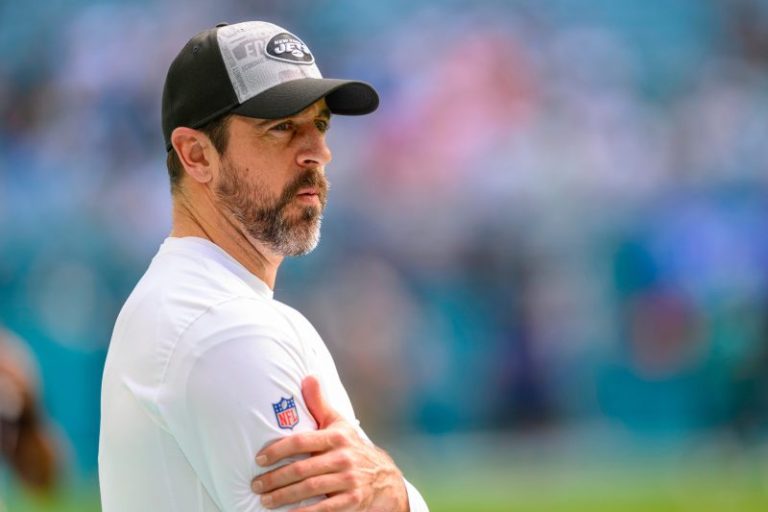

In an NFL season marked by unpredictability, one certainty has emerged: Aaron Rodgers is as good a self-promoter as he is a quarterback. Maybe better.

The four-time NFL MVP was never going to make it back this season. No matter the number of times he was seen throwing on the sideline or how many optimistic updates he gave, it wasn’t going to happen. The man had surgery to repair his shredded Achilles a mere 14 weeks ago. The fastest, most amazing recovery from such an injury by an elite athlete was five months. You do the math.

But Rodgers was committed. To keeping himself in the spotlight.

Once one of the more thoughtful and humble players in the NFL, Rodgers has made a late-career shift into carnival barker extraordinaire. He got hoodwinked by junk science during the height of the COVID-19 pandemic and somehow thought that made him an enlightened renegade. He spouted that nonsense and styled himself as a free speech warrior when he was criticized for it.

A tip for Rodgers: Free speech does not mean what you think it does. It means the government cannot silence you or take measures to limit your ability to promote your lunatic theories. It does not mean society cannot ridicule you for your arrogance and ignorance.

NFL STATS CENTRAL: The latest NFL scores, schedules, odds, stats and more.

Also, if you’re going to claim you’re being canceled, it might be better to not do it during your weekly appearance on a national TV show. A role for which you are paid handsomely, I might add.

But I digress.

Every quarterback – heck, every elite athlete – has an ego. They wouldn’t be where they are if they didn’t. But Rodgers seems to have a larger need than most to be the center of attention.

There were his word games about whether he wanted to return to the Green Bay Packers and who was to blame when the team moved on. His “darkness retreat.” His perfectly choreographed entry for the New York Jets’ season opener that would have been over the top even if he hadn’t previously expressed doubts about 9/11.

Even his shots at Travis Kelce, which just so happened to come after Kelce’s new girlfriend stole the spotlight from what was supposed to be Rodgers’ triumphant return to MetLife Stadium.

So it is no surprise that Rodgers would turn Achilles recovery into an NFL reality show. The surprise is how many people bought the shtick.

“If I was 100% today, I’d be definitely pushing to play. But the fact is, I’m not,” Rodgers acknowledged Tuesday on ‘The Pat McAfee Show.’ “I’ve been working hard to get closer to that but I’m still 14 weeks tomorrow from my surgery, and being medically cleared as 100% healed is just not realistic.’

Of course it’s not. It never was.

But now he’s saddled the Jets with the con, too. In order for Rodgers to keep practicing with the team, which doesn’t seem like a necessity for a guy who coach Robert Saleh said has no chance of playing, the Jets had to add him to the 53-man roster Wednesday. To do that, they had to cut fullback Nick Bawden.

Bawden might not be a marquee name, but he’s played in every game this season and is an important part of the run game. Which, given the Jets’ QB situation, is kind of an important component.

It was clear from his comments Saleh never expected Rodgers to come back this season. It was equally clear he doesn’t want to irritate his QB, who has been known to hold a grudge.

‘It’s all part of his rehab. There will be days he’ll be out there, days when he’s not,’ Saleh said of activating Rodgers. ‘We just have the roster flexibility. Otherwise, we wouldn’t be able to afford to do this.’

Do they really, though? Or did the Jets make the decision back in September that it was in their best interest to placate Rodgers and whatever notions he has and the hell with what’s best for the team?

That Rodgers has even gotten this far is amazing. He was able to return to practice Nov. 29, although in limited fashion, and nothing takes away from that. Rodgers will be an inspiration to other athletes who might once have feared losing nine months to a year to a torn Achilles, and doctors will learn things from this that will help the recovery of others.

But returning, even if the Jets had made the playoffs, was just not going to happen.

‘My instinct says if he was 100% , he’d probably be banging the door a little bit more. But like he said, he’s a couple of weeks away,’ Saleh said.

Rodgers dangling the idea this was even a possibility, though, ensured people would still be watching his every move and listening for each new update. It allowed him to take potshots at, well, pretty much everyone and further his own narrative as a truth seeker and iconoclast.

It was good theater, if you want to call it that, but it was never realistic. Which is besides the point. Rodgers managed to keep himself relevant this entire season despite being on the field for all of four plays.

By that measure, his recovery was a smashing success.

Follow USA TODAY Sports columnist Nancy Armour on social media @nrarmour.

This post appeared first on USA TODAY