In the 1995 film, Home for the Holidays, family reunions are explored using both drama and comedy. The film illustrates how we outsiders looking in never really know the love and the madness that goes on inside any one family’s home during Thanksgiving.

Happily, our Economic Modern Family tends to be transparent.

Beginning with our patriarch and matriarch, we see 2 different phases, similarities in leadership and divergent momentum. The Russell 2000 (IWM) is in a recovery or recuperation phase, trailing behind the SPY. Its momentum matches the price movement; both momo and price are struggling to clear key resistance. Furthermore, Granddad remains under the July 6-month calendar range low, certainly not a bullish sign. Gramps’ holiday leans more to underscoring the market madness we see in NASDAQ.

Granny Retail (XRT), has fared better since October 2023. Granny is in an accumulation phase, slightly outperforming the SPY, her momentum gaining traction. Granny is well beneath the July 6-month calendar range high, but has managed to clear back above the July 6-month calendar range low.

The consumers’ holiday mindset is one of cautious optimism.

In Home for the Holidays, it is up to the mom and dad to hold the family together. Hence, if we look to Granddad and Grandma to hold our economic modern family together, we must also examine the impact, or lack thereof, that relationship has on some of the other key family members or their grandkids.

Conveniently, Tommy in the film is a good representative for our Transportation (IYT) brother. Side note: the dad in the film is a retired airport maintenance man.

Tommy is complicated. His cracked sense of humor disguises a softer heart. IYT, our “Planes, Trains, and Automobiles” (speaking of movies), is also complicated. Through strikes, inflation, higher rates, and economic slowdowns, IYT is looking for love.

In an accumulation phase, IYT has a way better performance relative to the SPY. Yet IYT remains in a downtrend, under the July 6-month calendar range low. Momentum is in a bearish divergence to price, as it has yet to clear its 200-DMA while price has. Is IYT more inclined to lead or follow from here? That is a big question and one that we should watch for the answer to so we can assess if this rally is sustainable.

Sister Semiconductors SMH can be compared to the Holly Hunter character in Home for the Holidays. In the film, Holly Hunter supplies the point of view, and, like SMH, she tells us that the mania we see is not anything new. SMH is rallying beyond the rest of her Family, clearly NOT for the first time. The question is, can SMH continue holding up, given her grandparents and sibs remain mixed up?

SMH is in a bullish phase. It is trading in an uptrend above its July 6-month calendar range high. SMH is outperforming SPY, but momentum shows us a bearish divergence.

On Real Motion, the phase is recuperation, as opposed to bullish in price. Furthermore, the red dots which exhibit momentum, are below the 200-DMA and having a sell side mean reversion.

If you put these four charts all together, we get a reunion that is filled with the makings of a family breakdown. While Granny XRT and Sister Semiconductors SMH give us investors reasons to feel good about gorging ourselves, the rest of the Family (IWM & IYT) remind us not to eat what we cannot digest.

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Traders World Fintech Awards

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish and Maggie Lake cover inflation, technology, commodities and stock picks in this interview with Real Vision.

Mish talks trading range, fundamentals, and how to think about commodities right now on Yahoo! Finance.

In this appearance on BNN Bloomberg, Mish covers the emotional state of oil and gold, plus talks why small caps are the key right now. She also presents a couple of picks!

Learn how to trade commodities better with Mish in this interview with CNBC Asia!

Mish and Charles Payne discuss why the small caps, now in mid range still have a chance to rally in this appearance on Fox Business’ Making Money with Charles Payne.

Mish talks about Tencent Music Entertainment on Business First AM.

Mish talks bonds with Charles Payne in this clip from October 27, recorded live in-studio at Fox Business.

Coming Up:

November 28: Your Daily Five, StockCharts TV

November 30: Live Coaching

December 3-December 13: Money Show Webinar-at-Sea

Weekly: Business First AM, CMC Markets

ETF Summary

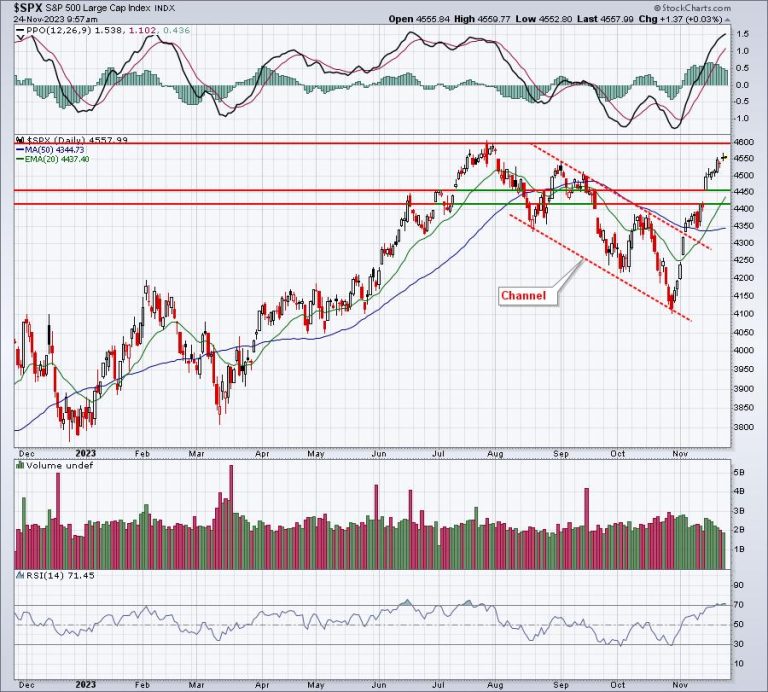

S&P 500 (SPY): 450 support, 465 resistance.Russell 2000 (IWM): 181 resistance, 174 support.Dow (DIA): 360 resistance, 346 support.Nasdaq (QQQ): 388 now pivotal support.Regional banks (KRE): 45 big resistance.Semiconductors (SMH): 160-161 pivotal support.Transportation (IYT): 235 support.Biotechnology (IBB): 120 pivotal.Retail (XRT): 65 resistance and 60 pivotal support.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education